China’s relative “safe haven” status could become more pronounced as it potentially benefits from a range of factors as follows.

Growth premium: China should be the only major economy to see growth ramp up this year as its covid recovery remains on track.

Excess household savings have provided a floor for an early recovery in consumption.

Financial soundness: China has made significant efforts to defuse financial risks over the past few years, with regulators rolling out new asset management rules to curb shadow bank risks and attempting to address property-bubble risks. The worst of China’s property downturn may be in the past, and Beijing appears determined to keep local government debt risks at bay.

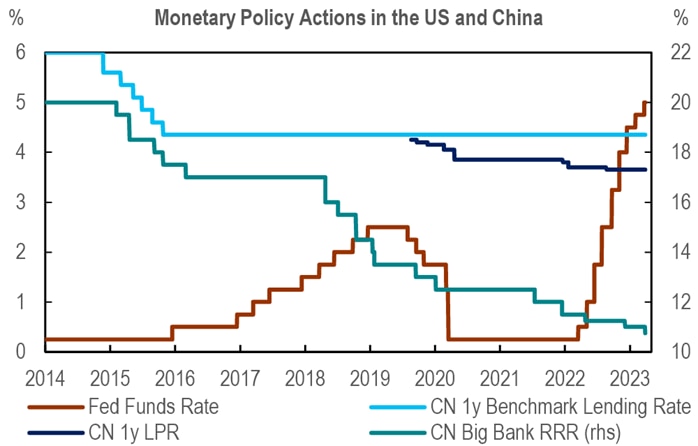

Policy discipline: The People’s Bank of China’s surprise cut to the reserve requirement ratio was a signal of policy support amid global volatility. The authors note that liquidity may remain relatively ample to contain contagion fears, but the loan prime rate has been unchanged for seven months.

The PBoC has been prudent in easing rates during the pandemic era, perhaps taking lessons from the U.S., and may quickly switch to wait-and see mode once growth is back on track. The authors expect 2023 to be a year of fiscal repair, without a massive financial stimulus or aggressive monetary easing.

A new political economy cycle: A new economic team is taking over in China. Development remains the top policy priority, and the policy mode is shifting from risk management to real business with a refocus on economic development. The reappointment of incumbent PBoC Governor Yi Gang and Finance Minister Liu Kun also means experienced hands in terms of economic policy. Pro-business, pro-private and pro-FDI policy initiatives may come from new premier Li Qiang in the coming months

US China Monetary Policy Divergence is Set to Peak Out

@2023 Citigroup Inc. No redistribution without Citigroup’s written permission

Source: Fed, PBoC, CEIC, Citi Research

The authors go on to offer several key takeaways from recent meetings during Citi’s China Macro Tour. These include the following:

China’s growth target shouldn’t be too difficult: All the experts agreed the growth target of “around 5%” shouldn’t be too difficult to achieve, but remained cautious about the economy’s weak links, with near-term concerns centered on whether consumption will recover. A number of factors could constrain that recovery, and if household confidence stays weak, there’s no guarantee that China’s high savings will translate into high levels of consumption this year.

What’s the source of growth over the next five to 10 years? Factoring in structural challenges, most experts saw China’s potential growth between 4% and 4.50% over the next five to 10 years, noting downside risks from demographic factors, policy uncertainties and supply-chain reconfiguration. That said, one expert still viewed “5% for the next 10 years” as completely possible.

The property sector remains a concern: Experts saw the real-estate sector as a smaller drag for China’s economy this year, and remaining an essential pillar of the national economy. They also saw less room for relaxing policy in coming months: Property prices are already showing signs of stabilizing or picking up, and there’s little room to relax purchase restrictions in the centers of top-tier cities. But long-term concerns remain, from developer debt to potential issues with nonperforming loans.

The private economy needs more policy clarity: The experts agreed that lack of policy transparency is driving weak confidence among private entrepreneurs. Policy coordination has also become less efficient in recent years, they said, with repairing balance sheets potentially taking a few years, particularly if confidence needs to revive.

For more key takeaways from these meetings and more on the road ahead for China, please see the full report here China Economics / Equity Strategy / Quant - Safe Haven / Slower-than-expected Recovery / High Rotation Risk (5th April 2023)

Citi Global Insights (CGI) is Citi’s premier non-independent thought leadership curation. It is not investment research; however, it may contain thematic content previously expressed in an Independent Research report. For the full CGI disclosure, click here.