A new report by Citi Research’s Ryan Winipta takes a deep dive into the Indonesian healthcare sector, and looks at how pandemic-induced changes in consumer behaviour are impacting health-tech.

Indonesia’s healthcare spending accounts for only c.3% of GDP, which is considerably smaller than in neighboring countries (Malaysia, Singapore, etc) and in bigger economies such as the US and China. Higher adoption of public insurance, in addition to increasing health awareness among the population, could pave the path to a faster rate of growth, according to the Citi report.

The e-health market, in particular – defined as devices, apps, pharmaceuticals sold via the internet, and online doctor consultations – is currently only a fraction of the total healthcare expenditure at c.US$1.3bn (c.3% of total). But it likely has significant growth potential on the back of higher adoption of smartphones, greater internet penetration, and more advanced offerings from Indonesian digital-health players.

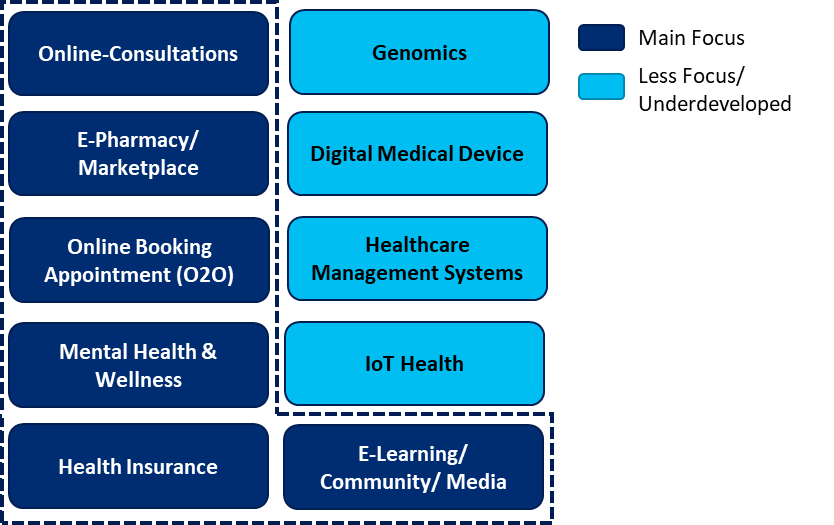

Key opportunities for health-tech

A look at the business models of several health-tech players overseas (e.g., in China and the US) suggests some key lessons that might also be applicable to Indonesia.

Health-tech ecosystem in Indonesia aims to solve basic healthcare problems | … thus most of the sub-vertical activities are mainly focused on such problems |

|---|---|

|

|

© 2022 Citigroup Inc. No redistribution without Citigroup’s written permission. | © 2022 Citigroup Inc. No redistribution without Citigroup’s written permission. |

Source: Citi Research, Tech in Asia, INSEAD | Source: Citi Research, INSEAD |

- Health-tech in Indonesia could explore the horizontals of healthcare services, such as wellness programs that cater to populations seeking weight-loss, fitness etc. The Covid-19 pandemic has made populations, especially in urban areas, more hygienic and health conscious. Mental health services could be another major growth area.

- Focusing on just one vertical of online-consultation may not be the best strategy in Indonesia.

- Extensive physical networks, preferably through partnerships rather than individually owned clinics/hospitals, should enable end-to-end services and a complete patient journey – especially with Indonesia being a specialist market.

- Health-tech players with existing user bases and ecosystems – either with big-tech or insurance companies – could generate higher user growth and grab market share.

- Strong B2C network is regarded as essential, as business’ or employers’ willingness to provide quality healthcare as a benefit to their employees is high.

- Externally, the government’s move to reform the national health system could change behavioral patterns toward managed-care over indemnity plans. Patients will have to meet GPs before going to specialists. Health-tech could provide a cheaper alternative to employers, insurers and individuals, with improving internet connectivity helping to overcome geographical issues.

- If online health consultation is reimbursed by the government through BPJS-Health, it would be a game-changer for the sector, says the Citi report.

Key challenges

- Indonesia’s healthcare system is specialists-oriented, with the majority of higher-income earners preferring to go straight to specialists, bypassing GP consultation, unlike the practice in developed countries. This might pose a challenge to health-tech players, as consultations with specialists often require a physical network and examination (blood tests, lab-testing, etc).

- Indonesia’s health-tech segment is in its infancy. This could pose a challenge for monetization efforts, as the market scale might not be large enough (yet).

- Geographical issues persist given limited offline presence (e.g., drug stores, hospitals), particularly in Tier-3 cities and rural areas.

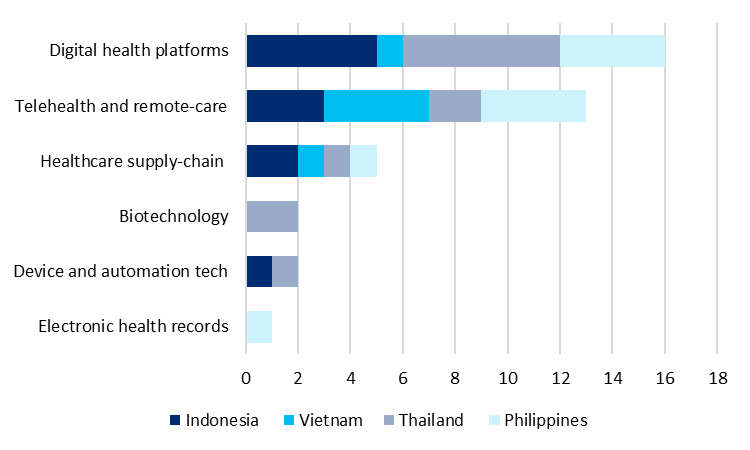

ASEAN Health-tech funding (US$ mn) continues to grow… | Indonesia e-Commerce vs Health-tech Funding (US$ mn) |

|---|---|

|

|

© 2022 Citigroup Inc. No redistribution without Citigroup’s written permission. | © 2022 Citigroup Inc. No redistribution without Citigroup’s written permission. |

Source: Citi Research, INSEAD, Galen Growth | Source: Citi Research, Tech in Asia |

- The B2B business might seem lucrative, but most of Indonesia’s employees work in informal sectors, where medical benefits are unavailable.

- Indonesia’s healthcare reform to promote preventive care will likely boost health awareness. But the execution and timeline are not yet clear.

The full report goes on to look at the lessons that Indonesia might draw from the health-tech experiences in the US and China and provides a run-through of some of the leading players. Please see Indonesia Healthcare - Health-Tech Clicking as a New Trend

Citi Global Insights (CGI) is Citi’s premier non-independent thought leadership curation. It is not investment research; however, it may contain thematic content previously expressed in an Independent Research report. For the full CGI disclosure, click here.