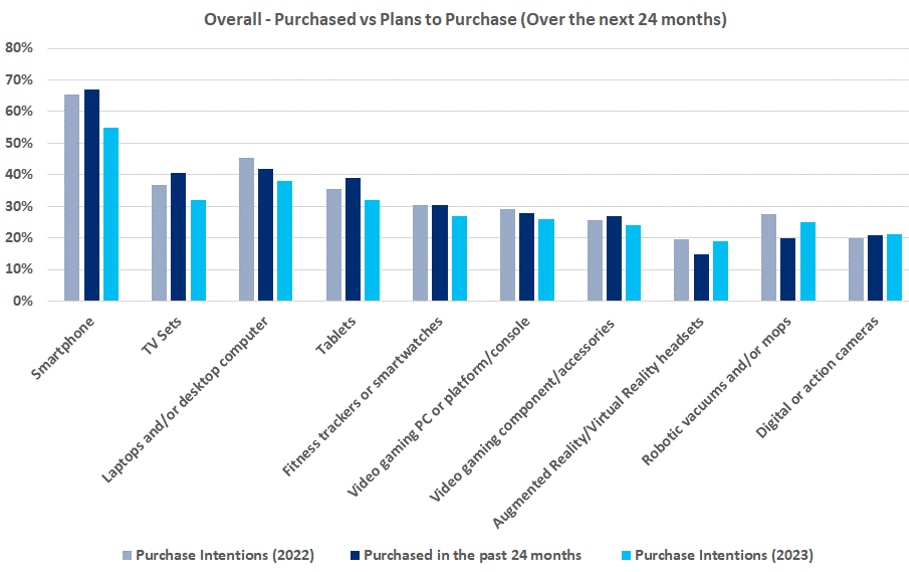

Overall purchase intentions for major devices are tracking downward relative to prior purchases. This suggests consumer sentiment remains pressured amid continued recession and inflation woes. China remains the weakest market of all the regions, seeing steep declines in smartphones. However, there are some green shoots, as within the US, there is an uptick of purchase intent (2023 vs. 2022) across most categories.

Purchase Intentions vs Prior Purchases

© 2023 Citigroup Inc. No redistribution without Citigroup’s written permission.

Source: Citi Research

Smartphone Demand Indicators Remain Weak. This can be attributed to China, which was partially offset by higher purchase intentions in the US compared with last year. However, on average, participants are willing to pay more for smartphones, up +6% year over year, implying the mix shift to premium devices continues.

Televisions. Amidst lackluster purchase intentions, bigger is better when it comes to TV sizes it seems, especially in China and US, consistent with recent OMDIA data in which monthly LCD TV display shipment weighted average size surpassed 50” in May 2023 (up 5% year over year).

Personal Computers, Tablets, and Peripherals. Dollar spending intentions have increased in both PCs and tablets, across all regions. Purchase intentions for peripherals continue to be mixed, with keyboards, monitors, and webcams making gains versus prior purchases and mice/headphones declining.

Gaming. Game console purchase interest has slightly declined in 2023 compared with prior surveyed years (27%➔29%➔26%). Overall, software purchase intent is around 60% within the next six months. Purchase intentions for AR/VR saw greatest increases across all regions.

Overall purchase intentions for AR/VR headsets and robotic vacuums saw an increase and digital/action cameras held steady. Purchase intentions for AR/VR saw greatest increases across all regions, while robotic vacuums and mops interest grew in the UK, US, Japan, and held steady in China.

The UK’s future purchase intentions compared with the prior saw declines across most categories; however, AR/VR, robotic vacuums, and cameras remained steady. Actual purchases compared with future intent was down in all categories, except for AR/VR, vacuums, and digital cameras.

Japan was added to the survey this year, and results for purchase versus intent followed suit with the rest of the regions surveyed, with indications that intent was down; however, laptops/desktops increased in intent, as well as vacuums/mops.

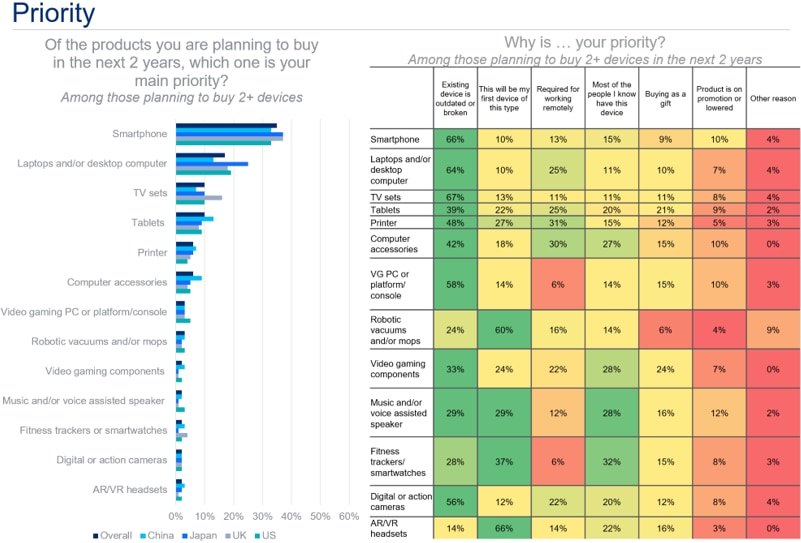

Priority

© 2023 Citigroup Inc. No redistribution without Citigroup’s written permission.

Source: Citi Research

Smartphones tops the list for priority purchases and purchase intentions (see above) in the near term, driven by a need to upgrade to newer devices or move to 5G. Globally, respondents expect to replace their current smartphones slightly sooner -- 2.3 versus 2.5 years.

Respondents globally are planning to spend more in future smartphone purchases compared what was spent on prior devices, implying continued premium mix shift opportunity, particularly in China and the US. Average spend is expected to increase +6% relative to last year, with China leading with +16%, then US at +10%, offset by -3% seen in the UK.

Foldable Phone Interest

© 2023 Citigroup Inc. No redistribution without Citigroup’s written permission.

Source: Citi Research

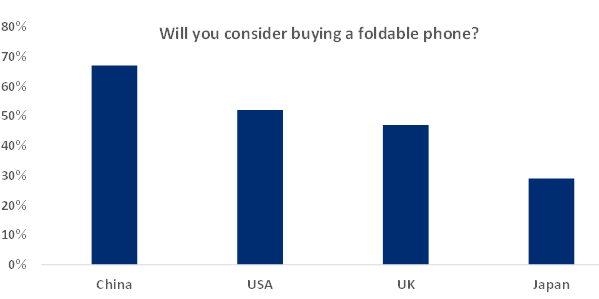

Foldable Phones. Of note was that interest in foldable phones ticked up. Users in all regions (ex-Japan not surveyed last year) are more likely to buy foldable phones. China and US are willing to pay more, an increase of spend compared with last year. It is apparent that foldable phone interest and price preference ticked higher and more device makers entered the market.

Remote Working

© 2023 Citigroup Inc. No redistribution without Citigroup’s written permission.

Source: Citi Research

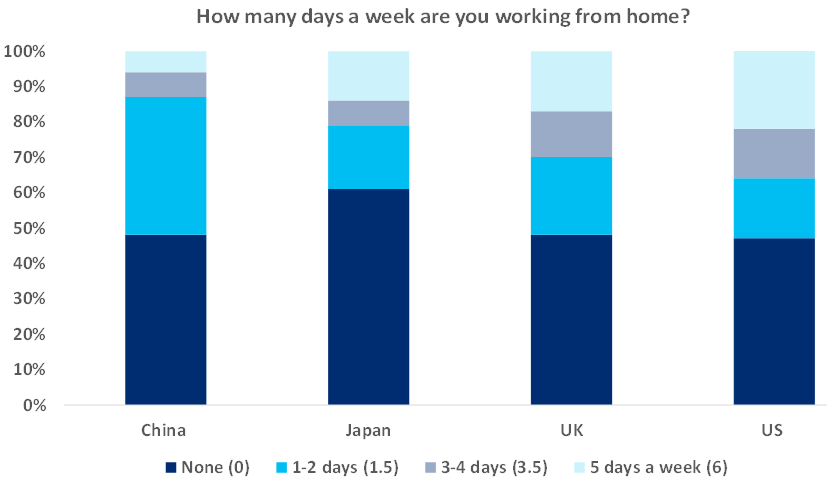

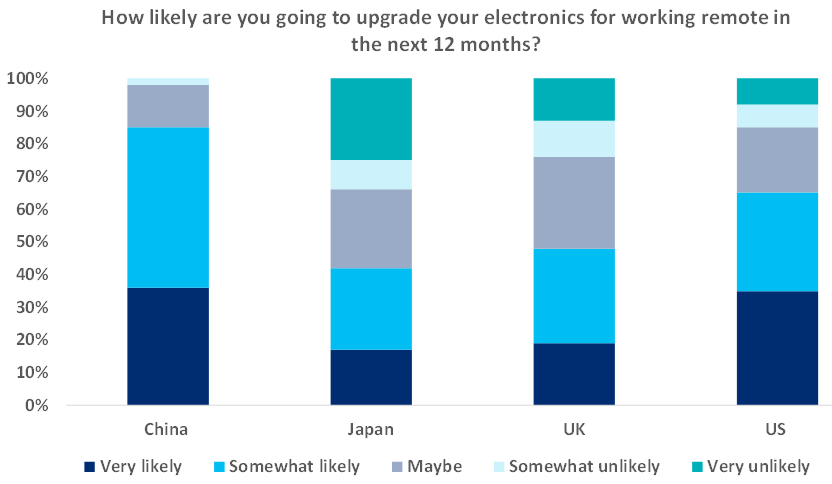

In addition, the note also looks at attitudes towards working from home with about 50% of the employed respondents indicated they were working from home at least two days per week, suggesting little change in the results since the survey last year. Unsurprisingly, survey participants indicated more than 60% were likely to upgrade their electronics over the next 12 months, which was the same as last year’s survey.

The full Citi Research note goes into greater detail and also looks at attitudes towards tablets, TVs, and also greater detail on wearable devices including particular products in the AR and VR market that are proving most popular with consumers.

For more information on this subject, please see the full report, originally published on 11 September 2023, here: Global Consumer Electronics and Hardware & Storage - Lackluster Consumer Tech Spending Intentions Persist

Citi Global Insights (CGI) is Citi’s premier non-independent thought leadership curation. It is not investment research; however, it may contain thematic content previously expressed in an Independent Research report. For the full CGI disclosure, click here.