How Nonprofits Can Get Greater Value From Their Donations

Events such as golf tournaments and galas are important fundraising opportunities for nonprofit organizations. Many nonprofits also receive large volumes of mailed checks. Since COVID-19 struck, these sources of funds have come under pressure. Lockdowns, continuing in many areas a year on from the start of the pandemic, have prompted the cancellation of most fundraising events. Concerns about standing in line at the post office have reduced the number of mailed checks, while places of worship that rely on cash collections have seen lower attendance (assuming they have remained open).

To compound the challenge faced by nonprofits, remote working has made the administrative tasks associated with processing donations more difficult to manage. At the same time, the fall in donations has occurred against a backdrop of increased demand for the services that many nonprofits provide. Charitable organizations offering healthcare services, mental health support or poverty alleviation have been especially important over the past year given the challenges many people have experienced as a result of COVID-19.

A number of nonprofits have pivoted successfully to virtual and online events to raise funds during COVID-19 lockdowns: there has been unprecedented creativity within the sector. Moreover, some nonprofits have been able to collect donations via phone or on their website via PayPal or another payment processing service. However, such collections have always been problematic for nonprofits given interchange fees of up to 3% and additional costs for credit card processing: given the small donations that many nonprofits receive, such charges can have a big impact on revenues. Historically, there has been limited use of lower cost ACH payments because it has been cumbersome to implement the necessary functionality.

Offering a flexible electronic solution

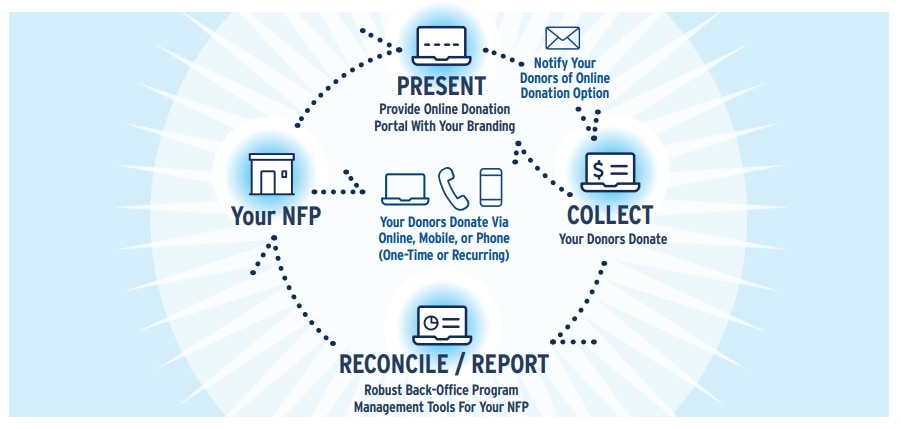

Citi’s Present and Pay solution was originally designed to help companies struggling to get their customers to pay their invoices on time or by a preferred payment method. This comprehensive electronic invoice solution helps solve this problem. Present and Pay allows companies’ customers to view, download, dispute and pay invoices online. However, Citi quickly saw the possibilities of this innovative technology to accommodate nonprofits, which often receive small donations. With the onset of the pandemic, Present and Pay’s capabilities have become even more attractive for nonprofits.

Present and Pay works via a secure web portal for the end to end transaction and donation process, including encrypted bank and card information. Crucially, depending on the package, the portal can be fully customizable with the option to integrate in the nonprofit's own website with its own branding. Research shows that donors may abandon the donation process because of cybersecurity concerns if they are transferred to a third-party site. With Present and Pay, the donor can simply click the ‘donate now’ button on the company’s website, and choose how they would like to pay.

Nonprofits can choose from a variety of payment options on Present and Pay, including ACH and credit card. Present and Pay helps nonprofits maximize revenue and minimize costs by reducing time and effort for staff to collect donations, and reducing expenses related to other receivables setup and fees.

Both one-off and recurring donations can be accommodated by Present and Pay. In addition, nonprofits can enable donors to create a profile that allows them to see a record of their donations, which improves convenience when donors are completing their tax returns, for instance.

Delivering longer-term benefits

Present and Pay offers immediate advantages to nonprofits by providing them with a cost-effective way to collect donations: it has been especially useful during the pandemic. However, the solution also has a number of additional benefits that should ensure it remains a valuable addition to nonprofits' toolkit in the long-term.

Many nonprofits have limited resources: staff, who may be volunteers, often multi-task, taking responsibility for fundraising, event management, marketing and many other functions. Present and Pay can be fully automated, reducing nonprofits' administrative burden, potentially lowering costs or freeing up staff time for more valueadded activities. Present and Pay offers an administrator portal that enables nonprofit staff to easily facilitate a donation taken via telephone. Users can also generate at-a-glance reports, making audits straightforward. Present and Pay is flexible with packages of varying complexity, allowing nonprofits to tailor the solution and integration with their other systems to their requirements.

Nonprofits' commitment to innovation and creativity have been evident when it comes to fundraising during the COVID-19 pandemic; many have achieved incredible results despite extremely challenging circumstances. By adopting Present and Pay, nonprofits have an opportunity to achieve a similar transformation of their donations process. The solution can reduce nonprofits' administrative burden, improve convenience and flexibility for donors, and – by reducing the use of checks and credit cards and increasing the use of low-cost ACH – lower costs, ensuring that a larger proportion of donations are directed towards nonprofits’ missions.