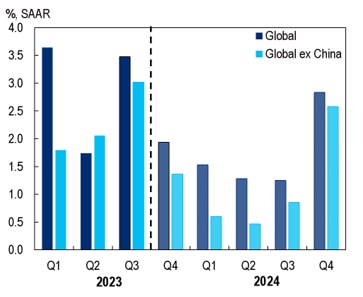

Citi Research analysts expect global growth in 2024 to come in at 1.9%. This projection has been marked down substantially over the past year. For 2025, they see global growth rebounding back to moderate 2.5%.

Those predictions come as, despite considerable headwinds, particularly on the geopolitical front, the global economy continues to show resilience.

A year ago, Citi Research analysts were predicting global growth to fall below 2% this year, with recessions in the United States, the euro area, the United Kingdom, Mexico, and Brazil. In fact those economies have all outperformed.

Now they expect that global growth will finish the year at 2.6%, a tick below its 3% trend, but up from their September forecast of 2.3%. This latest upward revision reflects strong data especially for the U.S. and India.

Citi Global Growth Forecasts

© 2023 Citigroup Inc. No redistribution without Citigroup’s written permission.

The heart of the global economy’s unexpected resilience has been that, coming out of the pandemic, global consumers clearly have pent-up demand for services. The strong spending, in turn, has supported the demand for labor, pushing unemployment rates down and wage growth up. These two factors have, in turn, further driven consumer spending.

Citi Research analysts say the path of services inflation through the year ahead is a central question. They say their view is that restrictive central bank policies now in place, coupled with an expected stepdown in global services spending, will allow services inflation to gradually cool. If not, central banks will be faced with the unpleasant prospect of maintaining tight policies for longer than expected or, perhaps, even hiking further.

Desynchronization has been the word of the year. Most major countries have their own, very particular growth trajectory and economic narrative. The United States is ending the year on the strong footing, China’s recent performance has been solid—if softer than expected; and the euro area looks to now be in recession.

Will this desynchronization continue in 2024? That’s really the big question. With the slowing global growth—and an expected US downturn—cyclical performance is likely to be more uniform across countries. That said, structural differences among the major economies are, if anything, even larger now than before the pandemic.

The world goes to the polls - Elections will be held this year in countries including Taiwan (January), Russia (March), India (April-May), the United Kingdom (likely April or May), Mexico (June), the European Parliament (June), Venezuela (H2), and the United States (November). The outcome of these elections will be pivotal and set the tone and trajectory for economic performance in these countries and colour the wider geopolitical landscape.

For more information on this subject, please see the full report, first published on December 1st here Global Economic Outlook & Strategy - Prospects for 2024: Still Not Out of the Woods

Citi Global Insights (CGI) is Citi’s premier non-independent thought leadership curation. It is not investment research; however, it may contain thematic content previously expressed in an Independent Research report. For the full CGI disclosure, click here.