Global Renewable Energy

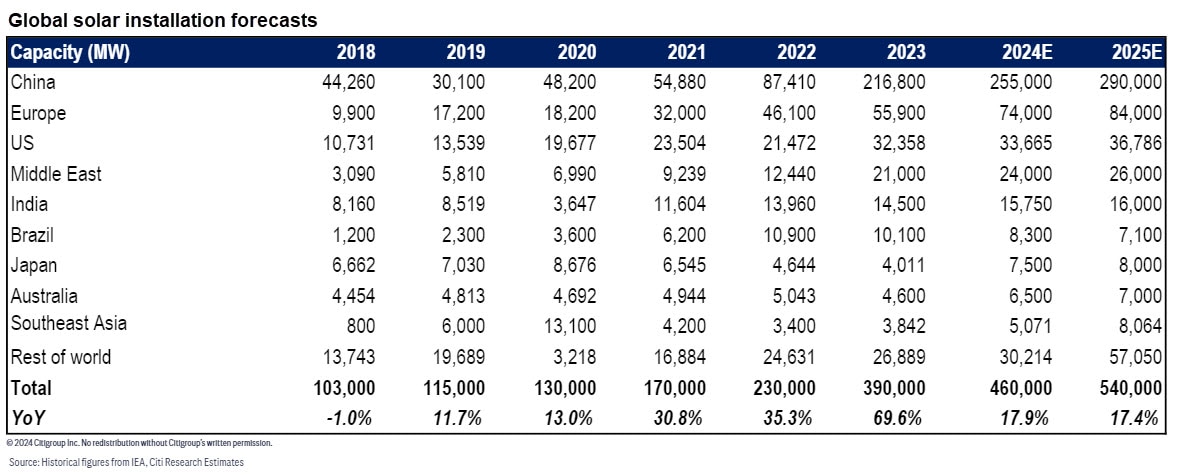

We lower our global solar installation forecasts by 3% for 2024 and by 4% for 2025 amid concerns about grid bottlenecks, with more capex to be spent on adding capacity, reinforcement and energy storage systems.

In our new Super-Sector Analysis, a team led by Pierre Lau looks at what may lie ahead for investment in global solar installations. We’re revising our global solar installation forecasts down by 3% to 455 Gigawatts (GW) for 2024 (up 16.7% year over year) and by 4% to 530 GW for 2025 (up 16.5% year over year), from previous forecasts for 470 GW and 550 GW, respectively.

Our revisions are prompted by concerns about bottlenecks for power grid transmission and distribution, and center on the U.S., China and Europe; in the last of these, 14 national transmission system operators (TSOs) plan to lag national solar targets by 89 GW in total, and only five countries have more ambitious targets (representing 66 GW in aggregate) in their TSO plans. China will remain the biggest contributor to global installations, representing ~54% of the total in 2024 and 2025.

More global grid investments are essential for spurring more renewable installations. We expect China’s national grid capex growth to accelerate to at least 7% year over year in 2024 from 5% in 2023. According to one forecast for Europe, around 173 GW of solar could hit gridlock by 2030, suggesting grid congestion will persist or grow worse over the coming decade. In the U.S., interconnection wait times have increased from less than two years for projects built in 2002–2007 to more than four years for those built since 2018, with more than 2,600 GW in the queue. And transformers, switch gear and substation equipment are all in short supply in the U.S.

We also see more demand for grid reinforcement and energy storage systems. The more renewables are integrated into the system, the more on-grid stability comes under pressure, as negative power prices from excess renewable supply during low-demand periods increasingly become part of the new normal. Energy storage helps balance daily fluctuations in output from solar and wind generation; by one estimate, energy storage capacity in Europe needs to grow 7.6 times to 156 GW by 2030.

Factors at work in our downward revisions to global solar installation forecasts include more prominent grid-consumption issues in China as grid construction lags behind renewable-capacity growth. We expect spending of Rmb230 billion on construction of Ultra High Voltage power transmission lines, as well as more investment in the power distribution network. In Europe, we see structural constraints such as longer permitting processes and underdeveloped networks and interconnectors. The current grid capacity also needs to be reinforced for more renewable consumption; RePowerEU has estimated that around €180 billion in investment in high-voltage grids is needed to achieve the EU’s target of 45% renewables share in 2030.

In the U.S., we expect a challenging environment for residential solar in the near term, with headwinds including high interest rates and California’s Net Energy Metering (NEM) 3.0 solar billing structure. Interconnection is the key bottleneck for U.S. renewable projects, which regulators have recently sought to address.

Turning to the solar supply chain, its geographical concentration in China intensified in 2023, according to the International Energy Agency. China accounts for more than 90% of cell, wafer and polysilicon manufacturing. For modules, China has around 80% of planned and existing capacity, with the U.S. and India far behind at 5% and Europe accounting for just 1%. The global manufacturing capacity for major solar components increased dramatically by as much as 114% year over year in 2023, with the highest growth seen in the polysilicon and module segment. This steep rise in capacity and excessive supply have led to fierce price competition. And foreign trade restrictions remain a major headwind for China’s solar module companies.

Our new report, Global Renewable Energy: Grid & Electrical Equipment Suppliers Gaining From More Solar Use, also includes forecasts for India and equity-strategy recommendations. It’s available in full to existing Citi Research clients here.