According to the World Resources Institute, nearly half of the AJP involves clean and climate-friendly spending. Politically, substantive progress may hinge on the Biden administration either extending or expanding existing policies that had bipartisan support. Adjusting current regulations on NOx, SO2 and particular matter could be a backdoor way of reducing carbon emissions. While carbon pricing is a more direct way to address the cost of reducing greenhouse gasses (GHG), it is questionable whether such a policy move would garner the necessary political support.

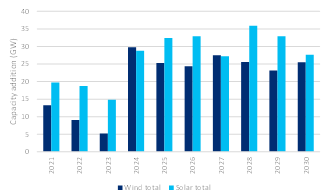

Under the AJP, President Biden is proposing a 10-year extension of investment / production tax credits (ITC/PTC) for renewables power generation. If annual wind and solar capacity were to grow at a similar pace to last year’s record 35-GW, this could add 90-GW of new capacity by 2030. The planned construction of at least 20-GW of high-voltage transmission lines could enable new wind and solar farms in more remote areas.

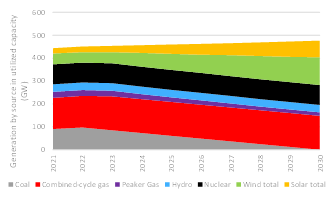

While green hydrogen could be a future solution for some sectors to decarbonize, it will take time to become competitive. Natural gas is still more likely to be favored given its availability, relatively clean burning properties and competitive economics.

Demand for natural gas could be supported by expansions of the bipartisan Section 45Q tax credit for carbon capture, utilization and storage. Independent of the initial Biden plans, this tax credit could boost CO2 pipes and CCUS (carbon capture utilization and sequestration) infrastructure. Net-zero carbon emissions from natural gas would mean the use of CCUS (to capture the GHG emitted). On the supply side, exports of excess shale oil and gas production give the US pricing power and geopolitical influence.

Further, if more ambitious clean-energy standards and carbon pricing are casualties of political opposition, then cutting emissions via regulations on NOx, SO2 and particular matter could benefit natural gas, as it has minimal levels of all of them.

|

Figure 1. US: Capacity additions of wind and solar |

Figure 2. US: Generation by major energy sources |

|

|

|

|

Source: EIA, Citi Research |

Source: EIA, Citi Research |

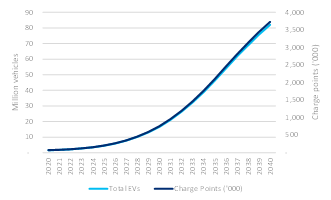

Under the AJP, a national network of 500,000 new charging stations for electric vehicles (EV) will be built by 2030, with incentives offered to state and local governments and the private sector. Assuming ~22 electric vehicles for every charge-point (based on the ratios in Norway and the US in 2019), the US could have 11 million EVs on the road by 2030. Applying the 22x ratio to the BNEF’s forecast of nearly 17m EVs by 2030E would require 750,000 charge-points. However, such calculations are overly simplistic given the distribution, density and type of charging facilities. And as Anthony Yuen writes, “the growth of EVs is likely to trigger ample private sector spending on superchargers, rather than the other way around.”

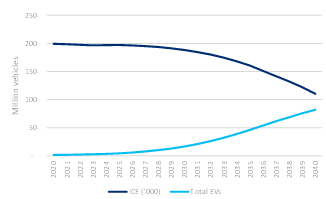

By the end of this decade, the growing prevalence of EVs could lead to an extra 5.5-8.5-GW of power demand and displace 0.4-0.6-mb/d of oil demand (based on 11m-17m EVs).

|

Figure 3. Potential number of charge-points needed to support the number of EVs, assuming a ratio of 22 EVs per charge-point |

Figure 4. US: Total number of EVs vs. ICE vehicles |

|

|

|

|

Source: EIA, BNEF, Citi Research |

Source: EIA, BNEF, Citi Research |

For more information on this subject, please see Clean Energy Weekly: Impacts of Biden’s American Jobs Plan

Citi Global Insights (CGI) is Citi’s premier non-independent thought leadership curation.It is not investment research. The comments expressed herein are summaries and/or views on selected thematic content from a Citi Research report. For the full CGI disclosure, click here.