The financial sector in Saudi Arabia has been developing fast, part of the social and generational change sweeping the country in recent years. That looks set to continue with the imminent arrival of digital banks into the market.

The Saudi Central Bank launched the Fintech Saudi initiative in 2018 to foster and grow the financial technology sector. The goal is to transform Saudi Arabia into an innovative fintech hub with a thriving and responsible fintech ecosystem.

The central bank’s sandbox for fintech admitted seven companies in 2018, 14 in 2019 and 11 in 2020. The year 2020 also marked the introduction of licences for non-bank financial institutions along with the introduction of the Open Banking Policy.

Fintechs under the SAMA sandbox currently include companies in debt crowd funding, digital savings, payments and buy now /pay later.

Overall, the fintech sector has grown from just 10 start-ups registered under the Fintech Saudi initiative in 2018 to a total of 155 in 2020. One important point is that Saudi fintech regulations are not bank-led, which means that fintechs do not need to be partnered with banks – and can operate relatively freely.

|

Drivers for KSA Banks ROA Advantage versus EM Banks – 2021 |

|

|

|

Source: Citi Research |

On the digital banking front, SAMA issued licensing guidelines and criteria for digital-only banks in early 2020, stipulating that an entitiy applying for a license had to set up as a locally incorporated joint-stock company with a head office in KSA and should have the following:

- Experience and knowledge in the financial industry, appropriate technology-related experience and knowledge;

- The financial capacity to support setting up a digital-only bank; and

- A team with adequate expertise to discuss relevant aspects of the application.

A business plan has to be presented, and capital requirements are decided on a case-by-case basis. During the summer of 2021, the Saudi cabinet approved the granting of the first two digital bank licenses.

|

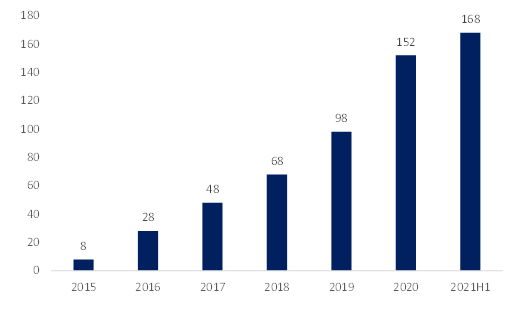

Total Venture Capital Investments in KSA (USD Mn) |

|

|

|

Source: Magnitt |

Those two licenses are unlikely to be the last given Saudi’s fast-growing venture capital scene, with capital deployed into the space growing rapidly (as shown in the chart above) and with Fintechs accounting for 25% of all investments so far in 2021. The kingdom is also experiencing rising interest from regional banks in the Saudi market and has a population receptive to the idea of switching to a digital banking experience. For more information on this subject, please see Saudi Arabia Diversified Banks – Digital Challenge 2021, published on September 8, 2021.

Citi Global Insights (CGI) is Citi’s premier non-independent thought leadership curation. It is not investment research; however, it may contain thematic content previously expressed in an Independent Research report. For the full CGI disclosure, click here.