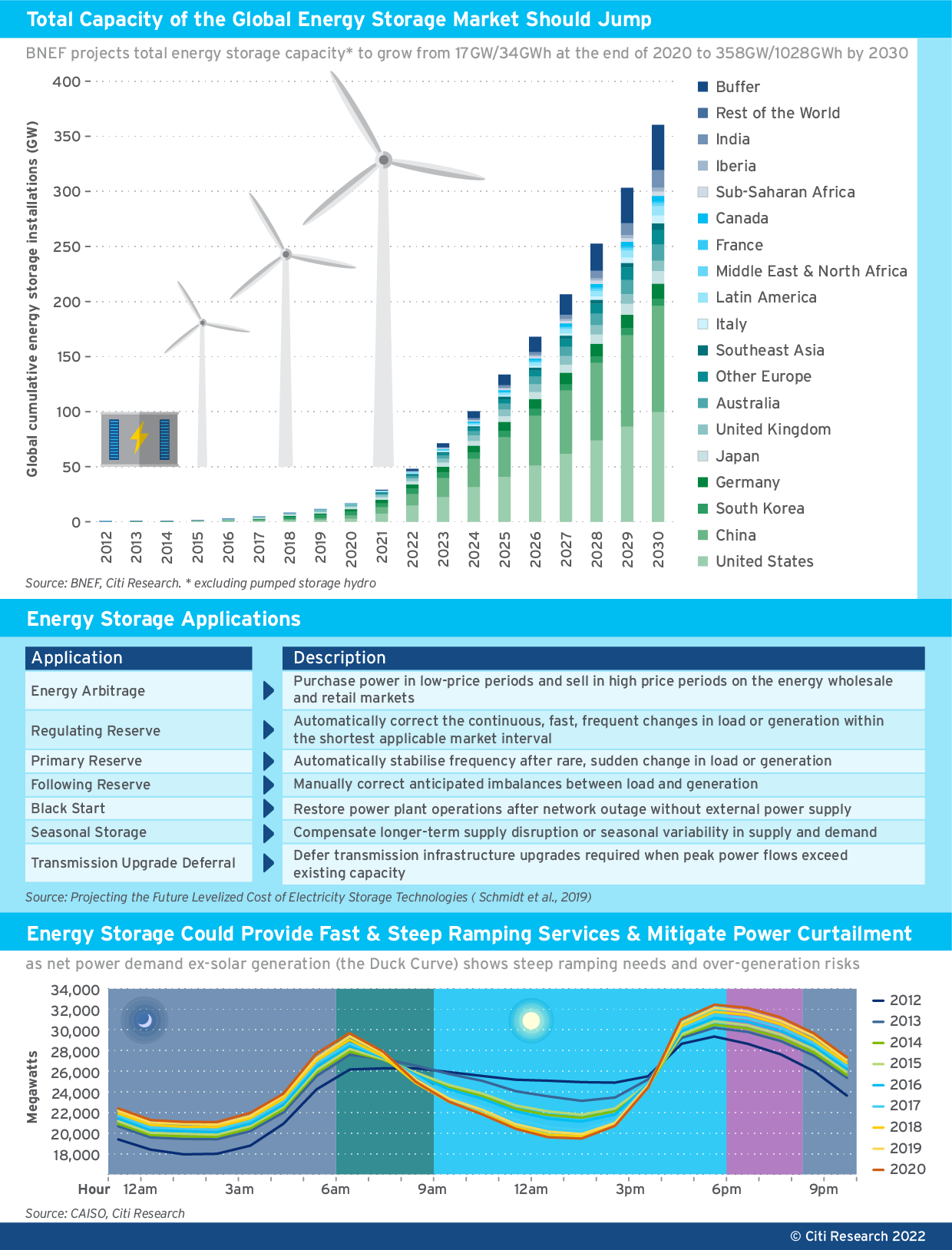

Stationary energy storage is vital along any path towards net zero in carbon emissions. The global market could grow by 20-35 times from 2020 to 2030, attracting over $250 billion of investments, according to figures from BNEF/IEA. If renewables is the ying, then energy storage is the yang that makes a decarbonized power grid function.

Globally, power market reforms and policy mandates are opening up massive market opportunities for energy storage. At the forefront are California, the EU and China.

Utility-owned storage projects are getting more common in California and also in China. Removing double charging of energy storage in the UK, and possibly in the European Union through new regulations could also be key.

|

Global energy storage market is set to grow significantly over the coming years, thanks to its wide applications in the power sector |

|

|

|

© 2022 Citigroup Inc. No redistribution without Citigroup’s written permission. |

|

Source: Citi Research |

Technological advances continue to challenge incumbents, as Li-ion batteries may lose some market share to alternatives such as sodium-ion batteries post 2025, for example. The full Citi report evaluates technical aspects of storage, including cycle life, round-trip efficiency, reaction times and discharge durations.

Energy storage is a critical piece of the Energy Transition puzzle, as it helps to balance electricity supply and demand, a role traditionally played by stored fossil fuels. It will become more important with the rising penetration of renewables power, since the sun does not always shine and wind does not always blow. In fact, what happened in 2021 – a windless and dry summer and early autumn in Europe and the worst drought in nearly a century in Brazil – reflects an urgent need for energy storage to keep up with the growth of renewables.

The US and China, currently the two countries with the most energy storage capacity, will likely continue to lead. BNEF sees the US and China each adding over 90GW of new capacity (excluding pumped storage hydro, or PSH) from 2021 to 2030, a combined 56% of the ~340GW of total global installations.

Citi’s theme machine and energy storage

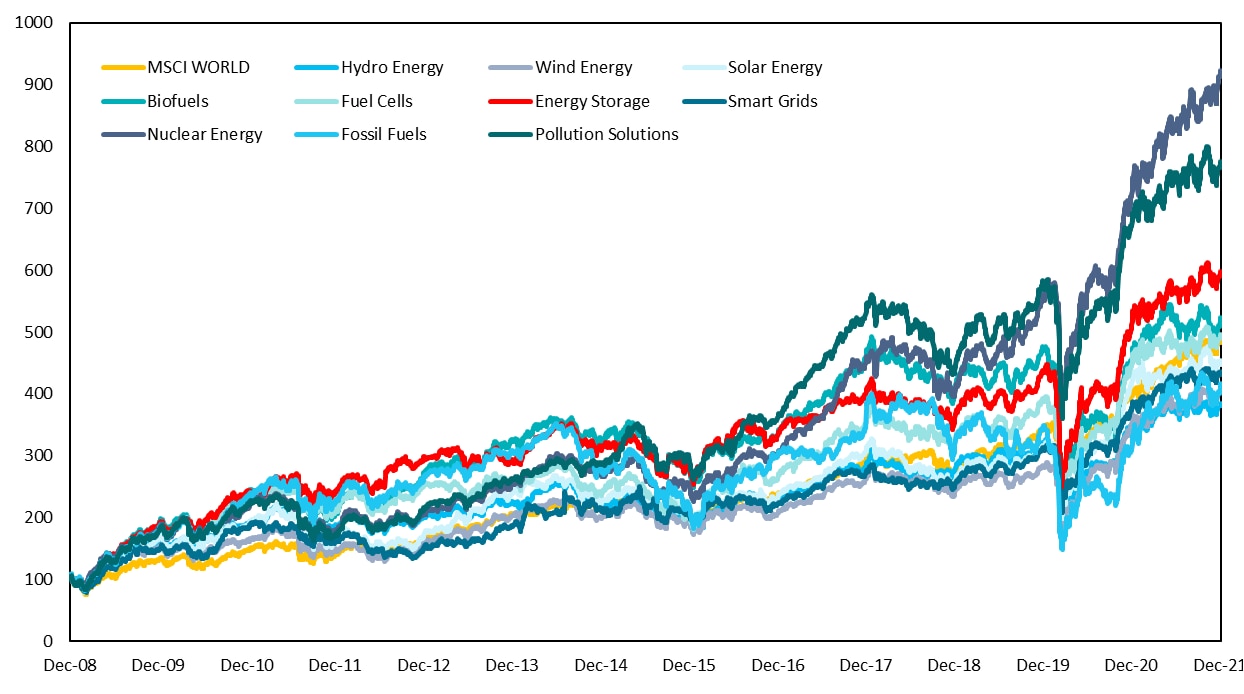

Energy Storage is one of 87 themes comprising Citi’s Global Theme Machine. The theme belongs to the Energy/Environment meta-theme, a broad thematic category which also includes Biofuels, Fossil Fuels, Fuel Cells, Hydro Energy, Nuclear Energy, Pollution Solutions, Smart Grids, Solar Energy and Wind Energy. Storage is seen as key to circumventing issues involving capacity, supply back-ups, and time shifting, including storing during low cost hours.

Over the longer horizon, energy storage has outperformed the MSCI World index as well as seven of its peer themes. It has struggled to compete to the same extent more recently, in particular when compared with more targeted/niche themes like nuclear energy and specific alternative energy sources. It has also generated relatively higher volatility, in part because it contains a more varied collection of stocks.

|

Cumulative returns since 2009 show that energy storage has outperformed MSCI World as well as seven of its peer themes that belong to the Energy Environment meta-theme |

|

|

|

© 2022 Citigroup Inc. No redistribution without Citigroup’s written permission. |

|

Source: Citi Research |

The full report goes on to mention how software companies can optimize battery assets as competition heats up given the space’s high margins and TAM growth potential. For more information on this subject, please see Energy Storage: Becoming Better Cheaper Longer - What’s needed for stationary storage to make renewables fully viable?, published on February 14th.

Citi Global Insights (CGI) is Citi’s premier non-independent thought leadership curation. It is not investment research; however, it may contain thematic content previously expressed in an Independent Research report. For the full CGI disclosure, click here.