The future of German manufacturing is important not just to Germany, but to the EU as a whole.

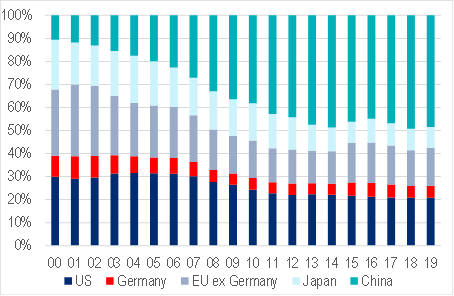

German manufacturing accounts for a quarter of EU industry and 10% of Advanced Economies’ industry – as the first chart below shows.

Germany’s large manufacturing firms serve as a gateway to dynamic markets such as China --where Germany accounts for about half of EU exports.

|

World -- Share in Manufacturing GVA (%) |

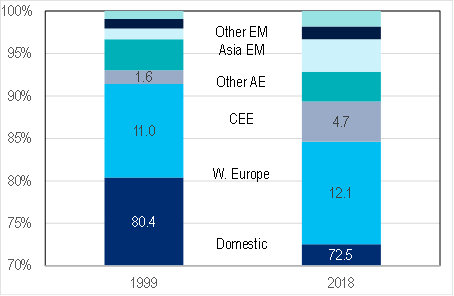

Germany -- Share of Value Added in Exports (%) |

|

|

|

|

© 2022 Citigroup Inc. No redistribution without Citigroup’s written permission. |

© 2022 Citigroup Inc. No redistribution without Citigroup’s written permission. |

|

Source: Citi Research, National Statistical Offices |

Source: Citi Research, OECD TiVA |

German manufacturing has also been behind Germany’s large trade and current account surpluses, as well as Europe’s build-up of savings into external assets and thus Germany’s position as a net creditor. This has arguably influenced Germany’s approach to EU and Eurozone policy.

|

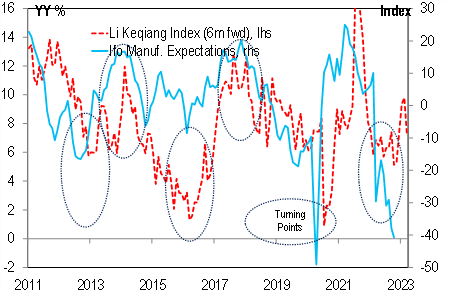

Germany, China -- Li Keqiang Index (YY %) and Ifo Manufacturing Confidence (Index) |

Germany -- Share of Firms Which Have Changed Their Supply Chain Strategy (%) |

|

|

|

|

© 2022 Citigroup Inc. No redistribution without Citigroup’s written permission. |

© 2022 Citigroup Inc. No redistribution without Citigroup’s written permission. |

|

Source: Citi Research, Bloomberg, Ifo |

Source: Citi Research |

De-Globalisation or just Diversification?

Since 2017, the trajectory of German manufacturing has shifted downwards.

(1) It started to slow immediately after Chinese growth rolled over from late 2017 onwards- see the chart on the left above. US trade wars also played a role. But that was a global slowdown, to which Germany was merely more exposed than other economies due to its greater manufacturing share.

(2) The same applies to the pandemic-related turbulences. Germany’s share in global advanced economies exports – another measure of competitiveness – was broadly stable and in line with what movements in the real exchange rate would have predicted.

The combination of China’s slowdown/rotation to a less investment-intensive economic model as well as geopolitical tensions and populism risk expressed in the US trade wars along with the vulnerabilities of global supply chains highlighted by the pandemic, triggered a rethink of globalisation by German and European firms:

- On the demand side, in January 2019, Germany’s industry federation BDI published a revolutionary report on relations with China which for the first time comprehensively acknowledged China as a “systemic competitor”, calling on EU cooperation to improve competitiveness and enforce a level playing field. However, unlike the US, the conclusion was not an attempt to roll back China’s rise, but to better manage relations with China as a market and competitor.

- On the supply side, making supply chains more resilient rapidly rose to the top of corporate agendas. In May 2021, the Ifo Institute found that only 44% of manufacturing firms were considering changes to their global procurement strategies, in 2022 that share had effectively doubled to 87%. 68% of (mostly smaller firms) had increased warehousing, 65% (mostly larger) diversified their supplier base. While re-onshoring to Europe was more of a minority strategy (25% of the firms which had made changes in 2021 responded this, in 2022 the question was not asked), there were some sectors such as semiconductors where governments pushed for it.

Energy producer prices have tripled in Europe since 2019, with Germany experiencing the largest shock, while they have only risen by 30-40% for rival economies such as the US or Japan. In particular, gas prices have differed widely with the US and, to a lesser degree, Asia, where due to long-term LNG contracts, few firms actually paid the spot prices.

Headwinds from de-globalisation, erosion of price competitiveness and the energy crisis clearly present challenges to Germany’s manufacturing businesses. But analysts point out that German industry has survived major challenges before, overcoming them via economic adjustment, business acumen or policy.

For more information on this subject, please see European Economics Weekly - Germany – From Energy Crisis to De-Industrialisation?

Citi Global Insights (CGI) is Citi’s premier non-independent thought leadership curation. It is not investment research; however, it may contain thematic content previously expressed in an Independent Research report. For the full CGI disclosure, click here.