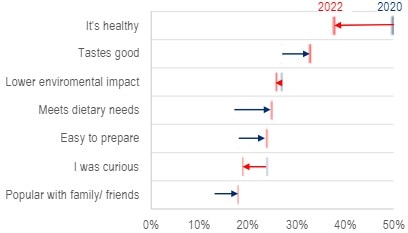

For years, the plant-based meat sector was a high-profile growth story. That growth stalled in 2020, with fewer consumers convinced of the health benefits.

But Citi’s new report says new technologies, including precision fermentation, mycelium and cultivated meat could change things. All these and more are explored in detail in the full note.

Third-party forecasts suggest non-animal meat will return to a 15-25% growth rate, implying retail sales in North America and Europe of $20-40 billion in ten years.

Plant-based and traditional meat volume in U.S. retail |

Reasons for consuming plant-based meat |

|

|

|

Source: Nielsen and CGI analysis |

Base = Americans who consume plant-based meats every few weeks or more often Source: Food Industry Association: Power of Meat, 2022 |

Any revival would lead to opportunities for start-ups, because established players don’t have a lock on what should be a significant market. Already most of the main meat processing companies have venture arms making investments in the non-animal meet sector.

Non-animal meat could also represent an opportunity for consumer megacaps.

These companies typically focus on products that are:

- scientifically validated

- benefit from branding

- require mass distribution

Non- animal meats fit the bill perfectly. The megacaps’ cash-flow, patience and distribution muscle should give them real advantages too.

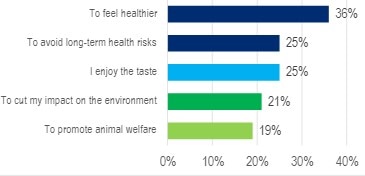

It turns out that consumers say they buy plant-based meat principally due to the perceived health benefits.

Top 5 reasons to consume plant-based meats, according to Euromonitor studyGlobal. Study conducted in 2021. N=14,197 |

|

| Source: Euromonitor |

Environmental concerns and animal welfare are less important for consumers, particularly in the U.S.

Extrusion

The most important technology behind plant-based meats is high-moisture

extrusion. It’s this technique that has allowed companies to make a plant-based product that has a texture that resembles traditional meat.

That’s important because replicating the texture is one of the chief problems for

non-animal meat. The central difficulty is that animal meat is three-dimensional and fibrous, made of protein molecules that are formed in long chains.

By contrast the proteins in plants are jumbled up, often more like balls than fibers. The extrusion process helps with this because it denatures the plant-based

proteins, transforming them into long chains like those seen in meat protein

Financing

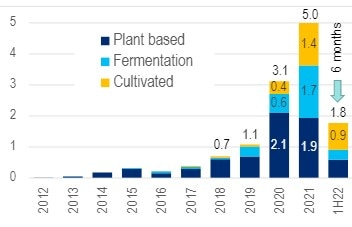

The view that sales of non-animal meats will start to increase again but move to

new technologies, is supported by flow of investments into start-ups.

The chart below shows both that the scale of financing has jumped since 2019, and also that the focus has moved on from plant-based products. The run-rate for 2022 is clearly down on 2021, but it still exceeds 2020, and is well in advance of any previous year.

Capital invested in alternative proteins ($ in billions)Mycelium products included in fermentation category |

|

|

Source: PitchBook, Crunchbase, Citi Global Insights |

The figure above also shows that most start-ups are working on fundamentally different technologies.

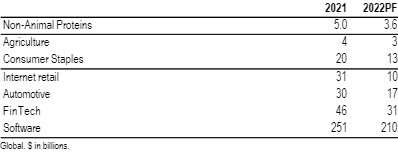

The investment in context

Within the world of agriculture and consumer staples, the investment in non-animal proteins is considerable. VCs invested more in these new proteins last year, than in all of agriculture. The $5 billion invested in alternative proteins was a quarter of the total invested in all forms of consumer staples.

VC investments in alt proteins vs. selected other industries |

|

|

Global. $ in billions Source: PitchBook, Crunchbase, Citi Global Insight |

However, it’s worth noting $5 billion pales in significance relative to the investment in sectors like “Finance” and “Software.” VCs tend to favor industries that don’t take long to prove themselves, can grow very rapidly, and don’t require much capital to expand. Software certainly fits this description; non-animal protein doesn’t.

We see four different conditions that we think are vital for success:

- product, (2) price, (3) acceptability, and (4) regulation.

Product (= Taste + Nutrition)

We expect that first precision fermentation, and then cultivated products, will significantly improve the consumer proposition, particularly for minced products.

- Precision fermentation can create flavor and fat molecules to enhance the taste of plant- or mycelium-based meats, which in turn will allow a cut in sodium and unhealthy fats.

- Mycelium does provide a much better texture.

- Cultivated meat should simultaneously have a taste that is much closer to traditional meat and be healthier. As we’ve said, it will be possible to lower the amount of unhealthy components and introduce healthy ones, for example omega-3 fatty acids.

Price

Currently alternative proteins are more expensive than traditional meats, which limits their appeal. We think the rate of decline will probably slow, but it is still likely that in the next few years, cultivated meat will first match the price of the traditional variety, and then become significantly cheaper.

Acceptability

We believe the biggest risk is around acceptability. Will people be willing to eat proteins derived from precision fermentation? Or cultivated meat? Will traditional farmers campaign more vigorously against such “unnatural” foods? Will they be successful?

Regulation

The new types of meat need regulatory authorization. We think this will be forthcoming over time, though it may take longer than many startups expect, especially in Europe.

- In a handful of small countries – Singapore, Israel and the UAE –governments are enthusiastically encouraging alternative protein manufacture to enhance food security. These countries do not have powerful indigenous livestock industries to lobby against it.

- The U.S. is moving to allow alternative proteins, albeit more slowly than the industry would like. Several precision fermentation products have been authorized by the FDA, although the process often takes 12-18 months. So far no cultivated products have been approved but we are hopeful this will change in the next 24-36 months.

- In Europe few breakthrough products have been given approval, in part due the political strength of traditional farmers. We think it could take several years (at least) for this to change.

- In China, the current five-year agriculture plan mentions alternative meat, implying the sector is on the government’s radar.

The full report goes into much greater depth on the history of plant-based meat, why sales grew and then stalled, and also delves into a range of emerging technologies. And the report features nine in-depth interviews with leading start-ups. For more information on this subject. please read the full report here Meat Meets Tech - The future of meat is likely to be driven by new technology

Citi Global Insights (CGI) is Citi’s premier non-independent thought leadership curation. It is not investment research; however, it may contain thematic content previously expressed in an Independent Research report. For the full CGI disclosure, click here.