As the global debate on AI’s potential impact on almost everything rages on, its effect on the media and internet sector has drawn particular interest.

The report from Citi Research attempts to map the risk and opportunity from generative AI-based disruption.

Generative AI opens up opportunities for organisations or individuals to do a number of things including:

- Rapidly analyse and interpret large datasets without requiring enormous dedicated computer processing power

- Create relevant content at scale - whether it be text-based, audio or visual - with minimal effort

- Automate processes

Of course, there are limitations to the technology. For example:

- how generative AI tools are trained

- whether they perpetuate bias (same issue)

- whether they are legal

- whether they actually work

This said, there is no denying that it is a ‘disruptive innovation’ for the media/internet sector because:

- consumer habits change fast and a large part of the media/internet sector is ultimately consumer facing

- traditional media companies, in particular, are often responsible for generating content with close control of the means of production, whether this be physical - recording studios, equipment, personnel - or more intangible - access to IP, creative - all key barrier to entry. Generative AI can reduce the barriers to entry, potentially to zero

- AI based tools could prove valuable for service-based businesses where the value proposition is creating productivity gains for companies (or individuals) by outsourcing time-/cost-intensive and/or domain specific functions

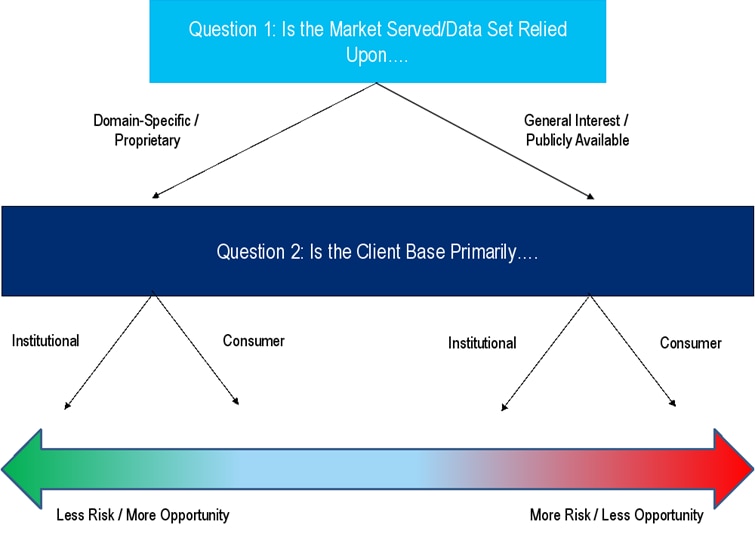

The research team pose the question that if we have a list of companies that are potentially more at risk of being ‘affected’ by AI-related disruption, how do we gauge if that risk is positive or negative? or whether it is likely to be quick to appear or more gradual in nature. The Citi research framework is predicated on two principles:

- A big database trumps a good algorithm

- Consumers move faster than institutions

For more on this see the full report. But taking into account these two factors, the team has created the following aid to investors.

A simple decision tree to gauge AI risk vs opportunity

How is AI risk mapped?

Take, for example, a professional services firm offering some form of outsourced service which is readily replicable at scale and at low cost by a generative AI-based equivalent. In the first instance this may represent a significant challenge for that company, but it may also free up time/resources to serve more clients because human capital can be more readily deployed across a larger client base.

It may be that it stimulates demand in the end market - eg a generative AI tool that makes personal investing easier may end up resulting in more people choosing to save/invest for their retirement.

One potential historical precedent here is the emergence of software in the 1970s/1980s. No doubt professional services firms seen as potentially being vulnerable to disruption at this stage. But 50 years later, the impact has potentially been slightly different to what was originally envisaged.

Perhaps more subtly, consider Chess. When Gary Kasparov lost to Deep Blue, a primitive form of AI as it happens, in 1997 many felt it presaged the death of Chess. But a quarter of a century later, Chess looks as popular as ever.

The full note goes on to assess in depth the risk by sub-sectors including advertising agencies, broadcasters and content producers, video games and several others.. For more information on this subject, please see European Media and Internet - Mapping AI Risk & Reward Across Our Coverage (9 May)

Citi Global Insights (CGI) is Citi’s premier non-independent thought leadership curation. It is not investment research; however, it may contain thematic content previously expressed in an Independent Research report. For the full CGI disclosure, click here.