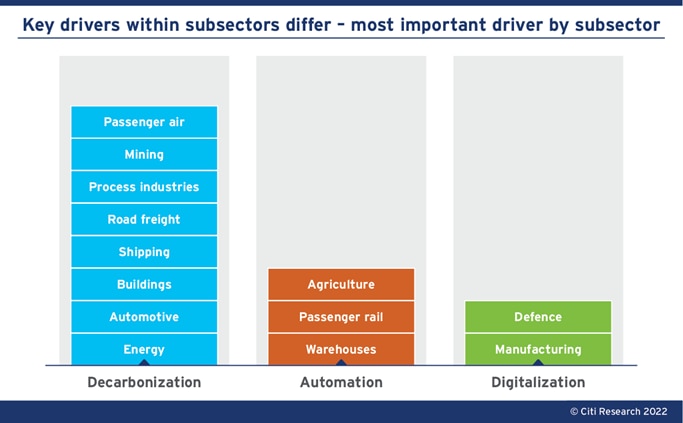

The super-sector is broad and diverse but we see three common secular growth themes across Industrial Tech & Mobility- namely Decarbonization, Digitalization, and Automation. Citi analysts expect these themes to feed on each other, driving growth and opening up new business models.

The pandemic has led to governments doubling down on emissions targets, and the supply chain bottlenecks exposed by the pace of recovery have accelerated needs in automation and digitalization. The Russia/Ukraine conflict has seen many governments focus on energy security, and spiralling inflation has refocused attention on automation. The declining birth rate in many countries following the pandemic means that demographics are set to remain a key driver of automation growth.

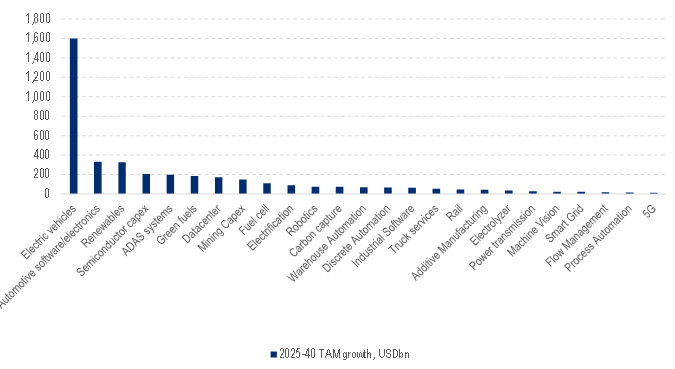

Citi analysts see largest TAM growth through 2040 in US$ terms in Electric Vehicles, Automotive Software, and Renewables. In % growth terms, they highlight end markets where they expect growth CAGRs of >2x global GDP through 2040, including electrolyzers, ADAS systems, fuel cells, carbon capture, electric vehicles, warehouse automation, green fuels, semiconductor capex, additive manufacturing, and machine vision.

Analysts see multiple examples of where the themes feed on each other. The electrification of energy use – spurred by strict emission targets - makes digital control a reality, opening the door to automation, and to new “as-a-service” models.

While one theme often “leads” (for example de-carbonization in energy, and automation in manufacturing), all three themes are present in each subsector, and often compound each other.

|

Key drivers within subsectors differ – most important driver by subsector |

|

|

|

© 2022 Citigroup Inc. No redistribution without Citigroup’s written permission. |

|

Source: Citi Research |

-

In some cases, de-carbonization is the leading driver - In automotive, other road transport and off-road construction, the electrification of motion – spurred by strict emission targets – makes digital control a reality, opening the door to automation in the form of autonomous driving, and to new business models.

-

In some cases, automation is the leading driver – Markets like warehouses are dominated by manual processes, with estimates of automation penetration as low as 10-15%. The twin drivers of eCommerce and supply chain bottlenecks necessitate higher automation penetration, aided by digitalization. Regionally, automation is in sharper focus in Japan due to the ageing population.

-

In some cases, digitalization is the leading driver – Manufacturing and some process industries are already highly automated, but digitalization through the IIoT is arguably the key driver here.

How the themes are driving change

-

Within decarbonization, the key areas of focus are power, transportation and buildings, all of which are major drivers of carbon emissions. Over the next two decades, analysts say there will be a major focus on decarbonizing electricity generation, moving away from fossil generation towards renewables (and to some extent nuclear in some countries), and then using this renewable energy in areas such as transportation or heating to replace other sources of fossil fuel usage. Where this is not feasible, carbon capture technology is likely to play an important role.

-

Within automation, a further increase in the penetration rate of automation within industrial processes is to be expected. In many regions and sectors, labour shortages due to skills gaps or demographic pressures are increasing the need for automation solutions. In many manufacturing industries the penetration of automation is already quite high (in particular auto assembly), limiting the extent of further automation in the coming decades. However, there are some subsectors where automation is still relatively rare, providing the opportunity for rapid growth. In particular, logistics, passenger rail and agriculture. In many industries, automation and electrification will go hand-in-hand, such as in the automotive industry.

-

Within digitalization, the increasing availability and use of data within the economy should open up opportunities for new business models (such as robo-taxis), new tools for analyzing and using data in key processes (within the category of industrial software) and providing opportunities in industries that underpin this digital transformation, such as datacenters and semiconductors.

Mapping out growth within the super-sector

The most rapid growth over the next two decades is likely to be in less mature market segments, which are only now gaining adoption. Key examples of this, analysts say, include the hydrogen space (electrolyzers and fuel cells), carbon capture, ADAS systems and electric vehicles. On the other end of the scale, areas such as flow management, process automation, rail and the smart grid are solid from a structural growth perspective, but unlikely to see clear above-GDP growth, given that they are focused on relatively mature markets. In absolute terms, the biggest opportunities come from the transformation of the automotive industry.

|

. Projected 2025-2040 addressable market growth by theme |

|

|

|

© 2022 Citigroup Inc. No redistribution without Citigroup’s written permission. |

|

Source: Citi Research Estimates, Company Reports |

|

Projected 2025-2040 addressable market growth by theme, USDbn absolute |

|

|

|

© 2022 Citigroup Inc. No redistribution without Citigroup’s written permission. |

|

Source: Citi Research Estimates, Company Reports |

Enablers of the key themes

De-carbonization, automation, and digitalization are driving forces across the sector. But looking further up the chain, bigger-picture factors have been catalysts for turning the potential investments in these themes into reality.

-

Government policy - In Europe, the EU Green Deal and Digitalization policy are two key pillars for the planned post pandemic recovery. In the US, the recently signed infrastructure bill includes spending in areas from electrification to cybersecurity and broadband. China, meanwhile, aims to reach carbon neutrality by 2060, as well as to reach the peak in its carbon emissions by 2030, while it also invests heavily in new technology infrastructure such as 5G. Demographics in Japan point to supporting robotics to support an ageing population, with energy policy aimed at achieving carbon neutrality in 2050 by increasing adoption of renewables and restarting nuclear power plants.

-

Demographics – Labour – both cost and availability – remains a major driver behind both automation and digitalization.

-

eCommerce – The changing nature of commerce has spurred investments not only in digitalizing and automating the supply chain and logistics, but also manufacturing more broadly.

-

Flexible supply chains – While the jury is out on how big an impact reshoring could be on supply chains, the effect of the pandemic in 2020 and trade tariffs in 2018/19 has meant supply chain flexibility has become paramount, with requirements in automation and digitalization.

-

ESG - ESG reporting requirements around areas like Scope 3 (supply chain) emissions, or the need to prove provenance, are significantly increasing the need for digitalized supply chains. Furthermore, the focus on ESG has created incentives for major firms themselves to reduce their carbon footprints, further accelerating decarbonization.

The full report goes into more detail on how these themes have been enabled by new IT/technology such as 5G, cloud infrastructure, semiconductors and the blockchain. It also looks at new business models including the ‘as-a-service’ concept, and robotaxis. To read it in full, please see Global Capital Goods - Industrial Tech & Mobility: The triumvirate of Decarbonization, Digitalization, and Automation

Citi Global Insights (CGI) is Citi’s premier non-independent thought leadership curation. It is not investment research; however, it may contain thematic content previously expressed in an Independent Research report. For the full CGI disclosure, click here.