Geopolitical risks are top of the news agenda again given escalating tensions in the Middle East. In turn, the question of how financial markets typically respond to heightened geopolitical risk becomes more pressing. The Citi Research report looks at this in more detail.

Here’s the background: Multilateralism’s decline and strained US-China relations have triggered a fundamental rethink about how global supply chains are organized. And active protectionist policies--most prominently the U.S. Inflation Reduction Act--have accelerated these trends.

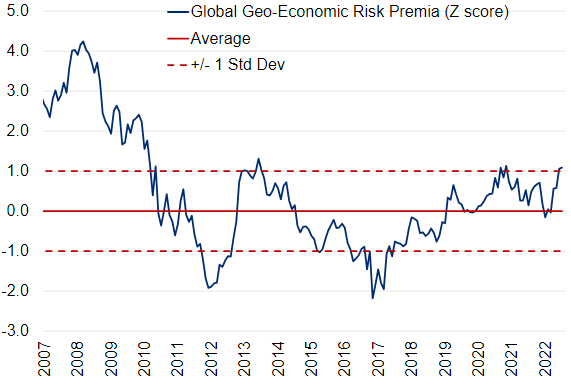

This has all led, the Citi Research report says, to a relatively large “geoeconomic” risk discount being applied to global equity markets, according to Citi Research’s newly constructed Geoeconomic Risk Premium (GRP) model.

Citi Global Geoeconomic Risk Premium Model (Z-Score)

© 2023 Citigroup Inc. No redistribution without Citigroup’s written permission.

Source: Citi Research, DataStream, MSCI

Themes that have been prominent lately, like “decoupling” and “nearshoring”, can be complicated and slow moving. But the report says they’re also here to stay. The Citi Research analysts outline how equity investors should think about (and position for) longer-term geopolitical realignment. Foreign policy, they say, is becoming ever more entwined with economic policy, and the report considers two channels through which shifting geopolitics can impact the global economy.

- Shifting trade patterns

The war in Ukraine coupled with rising US-China tensions have led to questions about cross-border trade and, in particular, whether the source and direction of trade flows will shift. And also, will deglobalization continue to gain momentum?

They point out that in China the country’s exporters are still competitive and that China’s export share is at 15%, a historically elevated level and above pre-Covid levels. That said, they say trade with the US does appear to be shifting, with the share of China exports destined for the US steadily declining in recent years, replaced in part by the Asean region and, to a lesser degree, by India.

In addition, Sino-Europe trade flows have been more resilient, with China recently gaining share in key European imports like autos and electronic equipment, suggesting Europe has done less to cut its exposure to China via trade, the Citi Research report says.

Citi Research economists have noted that if China is just rerouting its trade flows from US to Europe, then tales of China’s competitive demise may be overblown--for now at least.

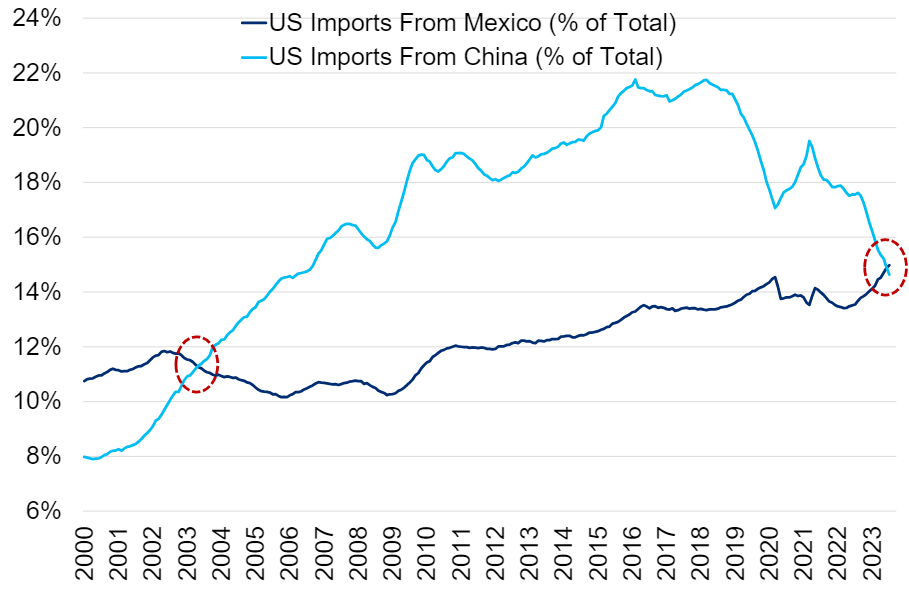

On the other side of the global realignment, Mexico is often mentioned as it now outpaces China in exports to the US (see the chart below).

Share of US Imports: China vs. Mexico

© 2023 Citigroup Inc. No redistribution without Citigroup’s written permission.

Source: Citi Research, DataStream, MSCI

That said, Citi Research economists say that Mexico’s share of US imports hasn’t actually risen as significantly as some may assume and is driven largely by autos.

2. Shifting Foreign Direct Investment Flows

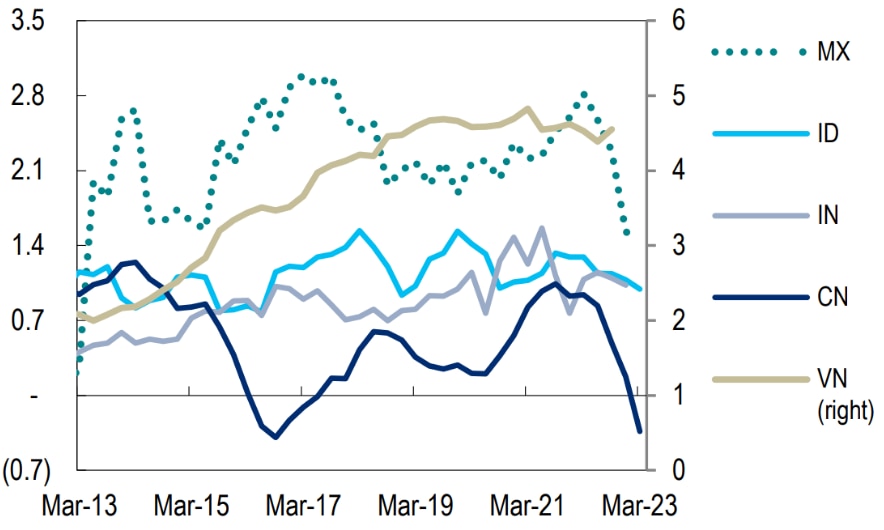

Aside from trade flows, the scale and direction of capital investment is likely to change in the new world order. Thus far, Citi Research economists find some evidence China is losing out on foreign direct investment (FDI) flows.

Net Foreign Direct Investment (4Q Rolling Sum, % of GDP)

© 2023 Citigroup Inc. No redistribution without Citigroup’s written permission.

Source: Citi Research, Haver Analytics, CEIC

Some of this could be due to global headwinds, but China is still underperforming other large EM peers like India and Indonesia. In Asia, announcements on factory relocation plans are supportive of India, Indonesia, and Vietnam going forward, the report says.

Again, Mexico is highlighted as a potential beneficiary via “friendshoring”. But Citi Research economists, the report says, are skeptical that productive capacity is being shifted on a big scale.

The full report goes on to look at equity market implications, saying that it’s clear that geopolitics will matter for the shape of the global economy in the years ahead, but that the realignment process is likely to be relatively slow moving. Against this backdrop, the report picks out three factors to consider: 1) higher geopolitical risk premia; 2) shifting portfolio flows; and 3) the growing influence of protectionist/industrial policies. For more information, please see the full report, first published on 10 October 2023, here: Global Equity Strategy - Navigating Geopolitics

Citi Global Insights (CGI) is Citi’s premier non-independent thought leadership curation. It is not investment research; however, it may contain thematic content previously expressed in an Independent Research report. For the full CGI disclosure, click here.