Front office software has been in a period of flux. After rapid SaaS growth in late 2020 to mid-2022 as the pandemic fueled digitization, the industry cooled from 3Q22 as interest rate hikes slowed demand and led to a softening of business conditions. This caused a change in buying behavior in the front office category, as organizations slowed hiring and eventually moved to layoffs. Meanwhile, the pace of new business formation declined, impacting momentum on new customer acquisition.

The emergence of COVID-19 forced businesses online and pulled forward demand for front office applications in 2020-21. If 2020-1H22 was marked by rapid adoption, 2H22-1H23 featured organizations adjusting to new budgets and lower headcount.

Five High-level Trends in Front Office

© 2023 Citigroup Inc. No redistribution without Citigroup’s written permission.

While Citi Research analysts say the “pain” in front office budgets is not getting worse, they note seat-based revenue models may still experience lagging effects given the multi-year contract length. Even if the macro outlook improves, they say, longer deal cycles could persist as companies optimize IT investments and scrutinize budgets on a longer horizon.

They note that the majority of their software coverage has announced layoffs, with many of these reductions coming within the past year. These headcount reductions, they say, may result in more protracted concerns for seat-based models as current contracts may not be adjusted down for lower headcount levels.

CIO Survey Indicates Greater Prioritization of Front Office/Digital Transformation Projects

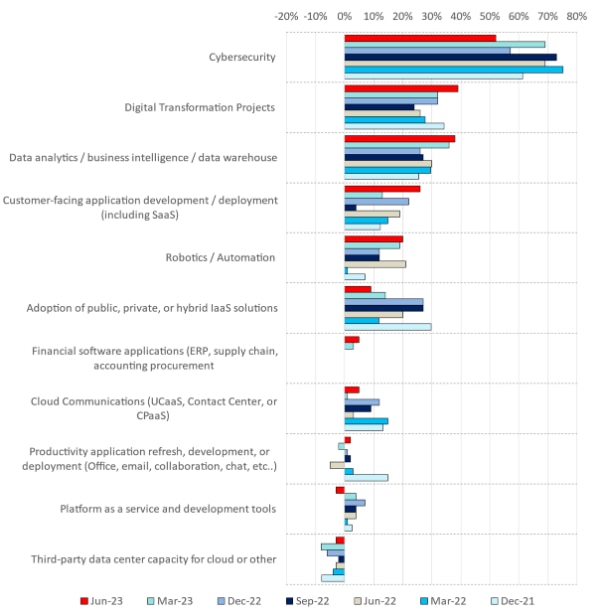

Digital transformation initiatives are a key driver of front office software spending. Hybrid work environments and increasing customer sophistication are forcing companies to adopt technologies that enable their workforce to be agile, providing better customer experiences to differentiate them from the competition. Citi Research’s proprietary quarterly CIO survey found that digital transformation projects and customer-facing applications have consistently ranked within the top 5-6 priorities since 2021, in addition to cybersecurity, adoption of public/private/hybrid IaaS solutions, data analytics, and robotics/automation.

‘Digital Transformation’ and Front Office Apps Consistently Rank in the Top 5 Investment Priorities

© 2023 Citigroup Inc. No redistribution without Citigroup’s written permission.

Source: Citi Research

Generative AI Could Be a Multi-Dimensional Tailwind but Not Without Risks

While the analysts say they are positive on the Generative AI topic across many areas of the software stack (for example, data management), they say the GenAI in the front office category can provide a unique tailwind. The reason for this, they say, is that front office offerings typically cut across creative content management and insights generation.

But, more importantly, they say the proximity of the category to “revenue generation” could fuel a wave of reinvestment given the increased importance of customer data, which can be used to drive stronger insights and personalization and ultimately result in higher conversion.

The full report goes on to look at areas including the evolving data landscape and impact on specific companies.

For more information on this subject, please see the full report, published on 5 September 2023, here: United States Application Software - Front Office at a Crossroads: Picking the Enablers, Avoiding the Bloat

Citi Global Insights (CGI) is Citi’s premier non-independent thought leadership curation. It is not investment research; however, it may contain thematic content previously expressed in an Independent Research report. For the full CGI disclosure, click here.