Citi Research analyst Hans Lorenzen reckons the case for levering up in corporate Europe isn’t matched by the data. Instead, caution--for now-- is the order of the day.

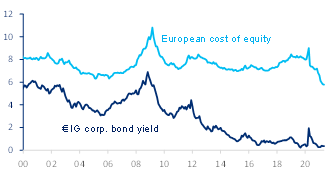

With the cost of debt still near historical lows in the corporate bond market and the incentive to reward shareholders strong as ever, especially with pandemic related uncertainty fading, the case for levering up looks compelling.

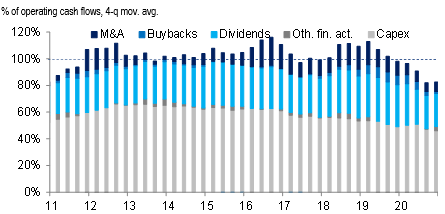

But in the real data on M&A, payouts and capex, there’s little sign that Europe’s corporates are being aggressive so far. Caution remains in abundance.

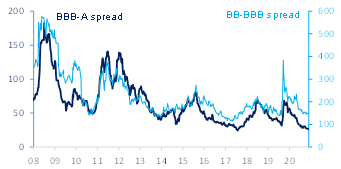

Markets are providing a strong incentive to sacrifice rating and take on more debt. And the penalty markets currently impose for taking on more debt is also low given the risk spectrum in credit is compressed.

|

Cost of equity much higher than cost of debt |

Getting downgraded doesn't cost that much anymore |

|

European cost of equity vs € IG corp bond yield, % |

Spread differences between broad rating buckets, bp |

|

Source: Citi Research, FTSE |

Source: Citi Research, Markit |

The trouble is that in Europe you could have made the same argument well before the pandemic hit. Indeed you could have made it pretty much any time over the past decade.

US companies have behaved more in line with textbook thinking. But management of European non-financial companies has tended to take a more conservative approach- perhaps due to uncertainty about domestic economic prospects.

If corporate leverage is to rise going forward, companies will have to get aggressive with their investment plans and rewards to shareholders versus the ongoing recovery in earnings.

Capex has been falling as a share of operating cash flows in Europe for a decade now, as seen in this next chart.

|

European corporate "discretionary expenditures" |

|

% of operating cash flows, 4-q mov. avg. |

|

Source: Citi Research, Bloomberg |

But during the pandemic, capex fell below 50% of operating cash flows for the first time. While part of that reflects a structural shift away from capital-intensive sectors, there is at least a possibility that capex has undershot in recent years, leaving an overhang that companies need to fill. Meeting climate objectives, booming commodities, the 5-G rollout, on-shoring and government stimulus could all serve as drivers of at least a cyclical revival in corporate investment.

Capacity utilization in the manufacturing sector, normally a leading indicator of investment, has rebounded quickly to near past cyclical highs. Certainty of demand is historically high, which should also boost confidence in capex decisions.

That said, capacity utilization in the services sector has barely rebounded so far, making a surge in capex in Europe much less likely, at least for the remainder of this year.

Hans also examines the prospects of shareholder payouts, including buybacks and dividends and delves into the question of whether M&A- long the most volatile component of discretionary spending- could still change things. For more information, please see the full note European Credit - Is Corporate Europe about to lever up?

Citi Global Insights (CGI) is Citi’s premier non-independent thought leadership curation. It is not investment research; however, it may contain thematic content previously expressed in an Independent Research report. For the full CGI disclosure, click here.