An aging population and rising labour costs are compelling Chinese companies to adopt automation quickly. The situation has echoes of Japan decades ago and South Korea years later. Realizing the urgency, China’s 14th five-year plan targets a robot density of 500/10k workers versus 246 in 2020. China’s automation drive will benefit the robot supply chain, in particular both foreign and domestic robot companies operating in the country.

While foreign robots should continue to dominate the high-end segment, they will likely concede ground to Chinese companies in the mass market, where end users tend to look at cost/performance ratios rather than durability. Citi’s Research analysts are optimistic about China’s robot demand in the long term given the government’s supportive stance and the country’s low manufacturing GDP per capita. While digesting China’s well-known automation story, the market tends to focus more on the industrials angle. The Citi Research report takes a more holistic view of the global supply chain and identifies beneficiaries.

Aging population, rising labour costs driving automation demand

Labour shortages have been growing in China, especially since 2010. According to China’s fifth and sixth census, China’s labor force (aged 15-64) increased from 889m in 2000 to 999m in 2010, representing 12.4% growth over the decade; however, the seventh census indicated that China’s labor force fell to 968m in 2020 from 999m in 2010. China’s labor force as a percentage of the total population dropped to 69% in 2020. The World Bank forecasts that China’s labor force will decline to 67%/62%/60% of the total population in 2030/40/50, from 69% in 2020, essentially replaying Japan’s experience from 1990 to 2020.

On top of the labour shortages, competition from the new-economy industries could also deepen the labour shortage in manufacturing industries. According to the latest survey by China’s on-line recruiting company Zhaopin, the IoT/IT sectors are still the top choice for fresh graduates; the auto and manufacturing industries rank fifth. Against this backdrop, there is a pressing need for China’s manufacturing industries to improve their competitiveness by either

-

adopting more factory automation to lower overall production costs or

-

upgrading to higher-end products with greater precision and customization.

Although China’s overall factory automation picture does not look promising in the near term, industrial robots in China are showing better promise due to the extended end applications (e.g., EV batteries and solar) as well as ongoing labor shortages. Over the past ten years (2011-20), industrial robot shipments grew at a 27% CAGR in China, outpacing the global pace of 12% and Japan’s 6%. The robot density in China, however, is still much lower than Japan’s, South Korea’s, and Germany’s, implying that upside potential for China’s industrial robots is significant.

Citi Research is optimistic about China’s robot demand in the long term given the government’s supportive stance and the country’s low manufacturing GDP per capita.

Industrial Robot Density Comparison |

|

|

|

Source: IFR, Citi Research |

Factory automation is widely employed in the manufacturing of chemicals, plastics, fertilizers, paper products, automobile assembly, aircraft production, and food processing. The benefits of automation include increased productivity, improved quality and consistency, and reduced human labor costs. The automated manufacturing process usually involves industrial robots, which comprise four key modules:

-

controlling systems,

-

actuator systems,

-

mechanical parts, and

-

sensors.

The sector has long been dominated by Japanese and European companies; however, Chinese companies are catching up with the foreign leaders and increasingly playing important roles in the industry.

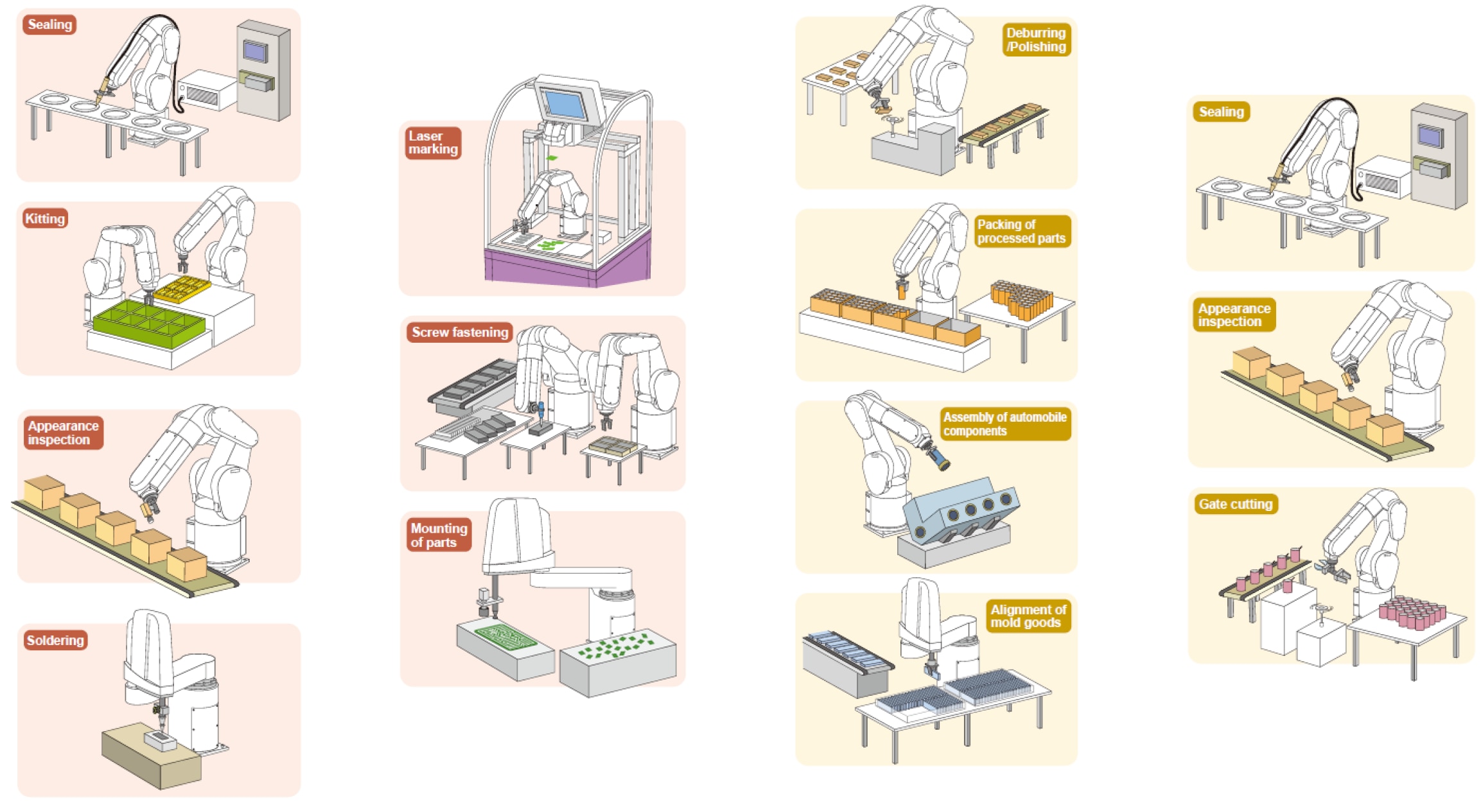

Applications of Industrial Robots

Source: Citi Research, Mitsubishi Electric

Current status of China’s robot industry

Industrial robots in China are showing better growth due to the extension of end applications and ongoing labor shortages. According to IFR (International Federation of Robotics), industrial robot installations in China increased by 20% YoY in 2020 – the year of COVID-19 – after two consecutive years of declines (2018-19), primarily due to investment slowdowns in the electronics and auto segments. Over the past ten years (2011-20), industrial robot shipments grew at a 27% CAGR in China, higher than 12% globally and 6% in Japan.

As per IFR, China represented 44% of global industrial robot installations in 2020, higher than 38% in 2019 and 36% in 2018.

China Industrial Robot Apparent Demand and YoY Growth |

China Industrial Robot Shipment and Domestic Brands' Market Share |

|

|

|

|

Source: Citi Research, CRIA, IFR, WIND |

Source: Citi Research, CRIA, IFR |

The main reason that China domestic brands still account for lower market shares in China is that domestic robot producers lack core technologies in key components, such has reducers, servo motors, PLCs (programmable logic controllers), resulting in low product quality or high instability. The resulting weak brand images make it difficult for China domestic robot makers to scale up production and scale down production costs per unit.

China’s lower manufacturing GDP per capita prompts higher robot density

Driven by continuous expansion of the economy, manufacturing upgrades, and labour shortages, China’s industrial robot shipments grew at a 27% CAGR over ten years, from ~15k units in 2011 to ~168k in 2020. During the same period, China’s robot density jumped 25x to 246 in 2020.

Although industrial robot demand has grown strongly, proliferation in China is still relatively low compared with other countries, such as Japan, South Korea, and Germany. This suggests that the upside potential for China’s industrial robot demand is significant.

Citi’s Research analysts expect that in the next five years, China’s robot density could increase at a faster pace than Japan’s and match South Korea’s pace during 2011-15, as China’s lower manufacturing GDP per manufacturing worker could prompt China’s manufacturing industries to adopt more industrial robots to enhance overall productivity.

South Korea is a good example of using industrial robots to improve manufacturing sector productivity. In 2010, South Korea’s manufacturing GDP per capital in USD terms was 24% lower than that of Japan; however, with improvements in its robot density, South Korea’s manufacturing GDP per capita outpaced Japan’s in 2014 for the first time. During 2017-20, South Korea consistently surpassed Japan in terms of manufacturing GDP per capita.

Robot Density by Country |

|

|

|

Source: Citi Research, IFR |

Another reason for optimism about China’s robot demand, according to the report, is the similarity of South Korea’s and China’s GDP structure. In 2020, the manufacturing industries represented 26.2% and 27.1% of total GDP in China and South Korea, respectively, while the number was only 20.3% for Japan. In addition, China and South Korea are both strong in the automobile and electronics manufacturing sectors, both of which require a higher volume of industrial robots.

On demographics, the workforce population (15-64 years old) accounted for 69% and 72% of the total population in China and South Korea, respectively while the group represented 59% of the total population in Japan. Thus, Citi’s Research analysts reckon that China could resemble South Korea in terms of further development of industrial robots. For more information on this subject, please see Citi Research’s report, China Robotics - Automation Story Now Gets Even Bigger (A Super-Sector Report), published 24 January 2022.

Citi Global Insights (CGI) is Citi’s premier non-independent thought leadership curation. It is not investment research; however, it may contain thematic content previously expressed in an Independent Research report. For the full CGI disclosure, click here.