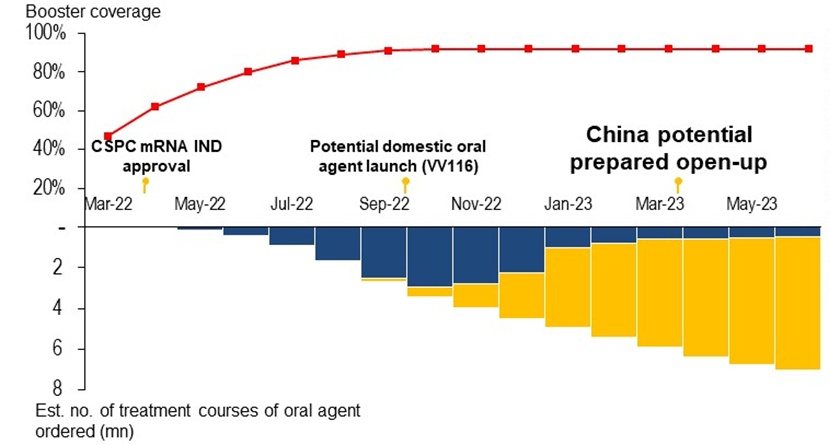

China may rely on booster coverage and oral agent stockpiles for its opening-up |

|

|

|

© 2022 Citigroup Inc. No redistribution without Citigroup’s written permission. |

|

Note: Assumption: govt. to purchase 1.5x and 3x no. of oral agents required in practice in 2022E/2023E for stockpile |

|

Source: Citi Research, the State Council |

Hong Kong may provide the template for a national solution — Hong Kong’s strategy of “boosters + antigen testing + oral agents” could be the blueprint for how the mainland’s Covid policies ultimately evolve. Under Citi’s measured opening-up scenario – which assumes a booster vaccination rate of 92% – a hospitalization rate of 0.6% of the infected population is estimated.

Covid-19 small molecules/vaccines — China will order 55million courses of small molecules between Mar. 22 and Jun. 23, on Citi’s estimate, with 37million of them produced domestically and the other 18million imported.

Predicting China’s Future COVID-19 Policies

Since Apr 2020, China has emphasized its strategy of “Zero Covid”. While the strategy allowed most people to lead relatively normal lives for the best part of two years, the wave of Omicron infections in major China cities has put this strategy to the test. Due to the dynamic pandemic situation and the prolonged closure of the country’s borders to the rest of the world, China’s Covid-19 policies are set to evolve, according to the Citi report.

Reasons for China’s zero tolerance

Citi analysts’ discussions with doctors who have been on the frontline in China’s pandemic-hit cities suggest the key official concerns are:

1) a surge in severe cases that overloads local medical facilities and

2) the risk to the most vulnerable sections of the population.

- The elderly: As this group has a higher risk of hospitalization from Covid-19 infection, the China government has stated that treatment of the elderly should be a priority.

- The very young: Children below the age of three are not approved for vaccination in China. Thus, if China were too quick to open up its economy, the public healthcare system could be prone to overloading, while those in the most vulnerable categories would be at risk of severe health repercussions.

Upsurge in severe cases could overload local medical facilities

China has 44 ICU beds per 1 million residents, according to Chinese Health Resources. Hospital resources would be at risk of being overwhelmed if the country suffered the Covid peaks seen in the West (patient demand for ICU beds in a number of countries reaching >80 per million residents).

The elderly and unvaccinated most at risk in pandemic

China had 78mn children aged below 4 (5.5% of total population) and 264mn elderly aged above 60 (18.7% of total population) in 2020, according to National Bureau of Statistics of China.

China has a total vaccination rate of 88%, with 48%/40% of the population having been vaccinated with three/two jabs respectively as of Mar 25th 2022. Since Oct 2021, The State Council had recommended booster shots for the general public due to waning vaccine effectiveness. For more information on this subject, please see China Healthcare - Road to Re-opening 2023

Citi Global Insights (CGI) is Citi’s premier non-independent thought leadership curation. It is not investment research; however, it may contain thematic content previously expressed in an Independent Research report. For the full CGI disclosure, click here.