What do banking stresses in the U.S. and Europe mean for the global economy? While the situation remains fluid and uncertain, Citi Research economists’ baseline outlook is for these strains to fade gradually (but unevenly) through the spring, with relatively modest effects on economic activity. The team’s baseline global growth forecasts are down only modestly from a month previously, and now stand at 2.2% for 2023 and 2.5% for 2024.

But they note that the 2023 growth projection would have been marked down more significantly if not for first quarter data coming in above expectations, particularly in the U.S. And the downside risks around the economists’ forecasts have become more acute, they say.

The banking turmoil began with a string of U.S. regional bank failures that led to concerns about further collapses and deposit flight from smaller financial institutions to larger ones. Those concerns jumped the Atlantic, leading to the fall and eventual sale of Credit Suisse, one of Europe’s largest financial institutions.

In assessing these concerns, the economists note that the financial system is better regulated and capitalized than it was during the 2008 financial crisis, and policymakers have taken vigorous, broad-based, and swift action in response to recent events.

Over the next few months, they say, pressures on U.S. midsize banks may occasionally flare up and some additional institutions may need interventions from the Fed and other regulators; the hope is that more failures will be avoided in Europe, but markets will be looking for signs of further vulnerability.

Effects on global growth

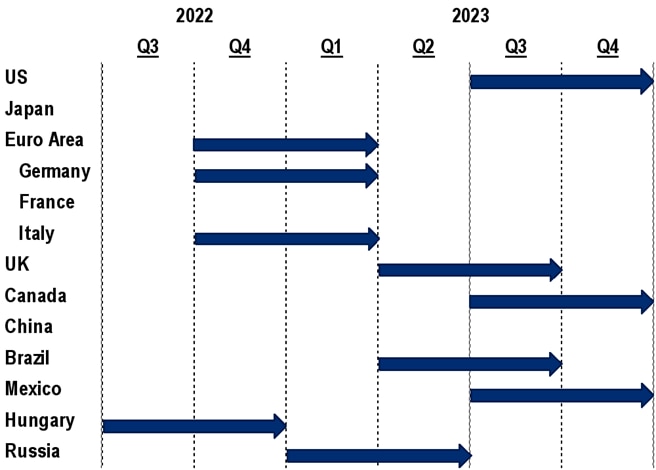

The economists continue to expect rolling country-level recessions in major economies, including the euro area in the first half of the year and the U.S. in the second half, with both China and Japan seen as likely to weather the slowdown relatively well.

Meanwhile, inflation pressures remain far too hot, running around 6% with only modest improvement seen this year on the way to a likely 4% in 2024. Pre-COVID, global headline inflation tended to average around 3% per year.

This outlook has been driven by recent strong core inflation readings as well as a shift in inflation pressures from goods to services, with that shift fueling labour demand and wage growth. The current environment poses significant challenges for central banks, which need to battle severe inflation pressures while remaining mindful of the stress put on some segments of the financial system by higher interest rates.

Both the Fed and the European Central Bank must balance price stability and financial stability. The central bank playbook for doing so is to use interest rate policy to control inflation and a combination of liquidity measures and other tools to stabilize the banking system.

But the team notes that as financial stresses evolve, the separation between those approaches can become blurred. Both types of actions tend to impact price and financial stability, and it’s hard to know in the very short run how they are permeating through the economy and the financial system.

Recession Forecasts*

© 2023 Citigroup Inc. No redistribution without Citigroup’s written permission.

*Note: Arrows indicate recessions. Source: Citi Research

While the economists’ baseline global growth forecast is down only slightly in the face of these bank stresses, the team notes that financial stability stresses are powerful and often unpredictable, and the current bank turmoil comes during a time when performance is already soft, with global growth hovering near its historical stall speed. That leaves the global economy more vulnerable. With that in mind, the economists sketch out three scenarios in which economic and financial effects prove more pronounced, with a larger-than-expected impact on growth.

Financial headwinds: In this first scenario, large-scale bank failures are avoided but worries persist well into the summer, causing credit growth to stagnate and global real GDP growth to slow. Central banks are pressed among their concerns for financial stability, slowing growth, and still-high inflation and respond by easing policy moderately.

Credit crunch: In this second scenario, financial conditions stabilize at levels a notch more severe than what prevailed before the Silicon Valley Bank failure, but banks move vigorously to de-risk their balance sheets, with these headwinds mitigating against any meaningful rebound in financial markets and driving a marked pullback in banks’ willingness to extend loans and take on other forms of risk, with the full effects of this painful process unfolding over the next 12 to 18 months. With the economy caught in a classic credit crunch, real GDP slows gradually but substantially, with growth falling to 1% next year. The weakening economy allows inflation to decline more sharply and central banks ease policies substantially.

Financial crisis: In this third and final scenario, the current stresses take hold, deepen and expand, with multiple bank failures in the U.S., Europe, and emerging markets over the next six months; non-bank financial institutions see stresses of their own; and there are periodic episodes of outright dysfunction for markets. The economy contracts this year and rebounds only weakly in 2024, with a steep deceleration in inflation and central banks cutting rates vigorously. The only positive feature of this scenario, the economists note, is that the issues are neither as deep nor as long lasting as the Global Financial Crisis.

In formulating the three scenarios above, the Citi Research economists assigned probabilities to them. The team sees the baseline as quite likely, with a 65% to 70% probability. The financial headwinds and credit crunch scenarios are assigned probabilities of 15% each, and the probability of the financial crisis scenario is seen as less than 5%.

The good news, the team notes, is that the global economy seems likely to snap back to the path it was on before the banking stresses emerged. The bad news is that there’s a roughly 1 in 3 probability of outcomes that are more severe.

And with the situation fluid and evolving rapidly, further updates to the scenarios and their probabilities will likely be needed.

For more information on this subject, please see: Global Economic Outlook & Strategy - The Path to Global Recovery—Banking Stresses Emerge (published 22 March 2023).

Citi Global Insights (CGI) is Citi’s premier non-independent thought leadership curation. It is not investment research; however, it may contain thematic content previously expressed in an Independent Research report. For the full CGI disclosure, click here.