Across Asia, more than half of businesses are still family owned, accounting for more than a third of GDP. Coupled with this, 82% of assets under management sit with first and second generations – compared to an average of 6th to 8th generations in Europe – who are only just now starting to seek out specialist financial advice. The market is hugely underpenetrated: the top 20 international banks in the region capture only about 10% of available APAC wealth.

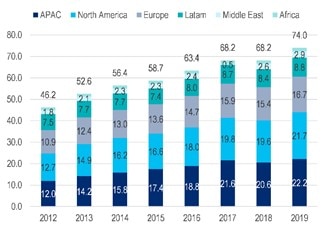

| HNW Population by Region 2012-19 (mn) | HNW Financial Wealth by Region 2012-19 (US$tr) |

|

|

|

| Source: Capgemini World Wealth Report 2020, Citi Research | Source: Capgemini World Wealth Report 2020, Citi Research |

This explosion of wealth in Asia, led by China, presents opportunities for local players, regional and international banks, fund managers and wealth managers. For many of them, it is a strategic priority. The report assesses the growth opportunity for international, regional and domestic banks, driven by mainland China wealth creation – onshore and offshore.

|

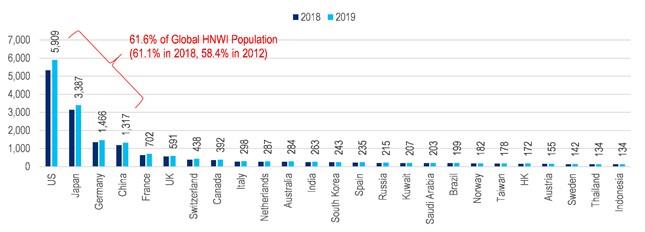

HNWI Population by Geography 2018-19 ('000) |

|

|

|

Source: Capgemini World Wealth Report 2020, Citi Research |

The onshore opportunity

Over the 2016-19 period, onshore assets under management (AuM) increased from 43% to 46% of total Asian high net worth AuM, according to McKinsey. Mainland China is increasingly opening up its capital markets to foreign financial institutions (FIs), which poses potential new growth opportunities for foreign financial institutions to serve the emerging middle class onshore. But the onshore market is dominated by domestic banks that have a broader customer base, wider distribution network and economies of scale. Domestic banks are also narrowing the product and service gap with international competitors, making head-on competition with domestic players a greater challenge for international players. Many international firms are still in the process of acquiring all the required licenses.

Retail leads the way

The Covid-19 pandemic has accelerated the digitization of financial services. Retail banks are so far leading the way. Regulators in the region have issued digital/virtual bank licenses that enable branchless banking and the incumbent banks are making efforts to match the digital capabilities of pure digital banks. In mainland China, internet platforms are playing an increasingly important role in the distribution of wealth products.

Private banks embrace digital

Clients of private banks tend to have complex financial needs that require more personal, tailored services. Such services have proven difficult to deliver digitally. That said, many private banks are boosting their digital capabilities so their relationship managers can better understand the risk profile of the clients’ investment portfolio and provide better advice.

FinTechs: Competition and collaboration

Many retail banks are working with robo-advisors to help mass-market clients to build investment portfolios. Meanwhile the BigTech client base is disrupting the wealth distribution model of retail banks. In mainland China, 11% of mutual funds are distributed through independent internet platforms. If internet platforms in mature markets such as Hong Kong and Singapore follow the same trend, banks’ fee income from mutual fund sales could come under pressure.

To the winners, the spoils

The sector is facing structural challenges of margin pressure due to low rates and competition from new fintech entrants. The winners are likely to need economies of scale to reduce costs and to give them the financial heft to invest in new technologies. They will also need an agile, simple business model that can adapt to shifting trends. International banks with retail operations in multiple markets could face the challenge of offering customized banking platforms in each of those markets, resulting in greater complexity.

The battle for Asia’s rapidly expanding wealth will be a vital pillar for financial services companies – domestic and international – for generations to come. For more information on this subject, please see Global Banks - Winning in Asia Wealth: Go Big, Go Onshore, Go Digital

Citi Global Insights (CGI) is Citi’s premier non-independent thought leadership curation. It is not investment research; however, it may contain thematic content previously expressed in an Independent Research report. For the full CGI disclosure, click here.