The past few years have underlined the importance of robust policy buffers in the face of a tidal wave of macroeconomic shocks.

The Citi research report argues that these buffers are arguably even more important given geopolitical and climate-related shocks look to be happening more often.

On conflict related shock, the report says a perceived waning of US’ political dominance- and an accompanying diminishing of the US deterrence factor- could affect its ability to safeguard allies.

On the geoeconomic front, meanwhile, the economic/ technology competition between US and China raises risks of increasingly inefficient supply chains.

On the environmental side, Citi analysts see rising risk from climate-related events amid rising global temperatures that could lead to extreme weather events.

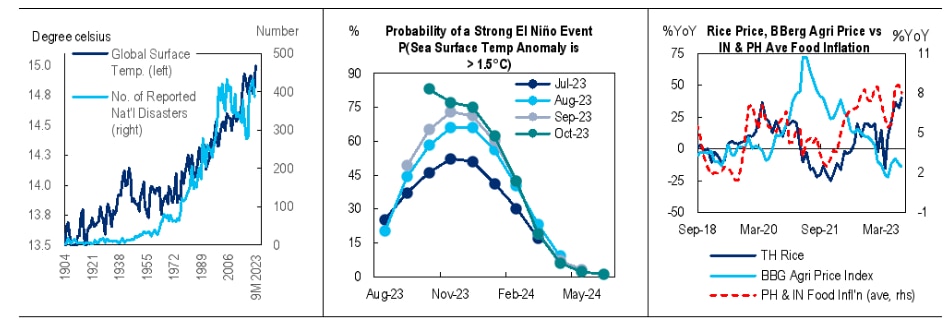

Parts of South and Southeast Asia are particularly vulnerable to physical risks from climate change, they say. El Niño is already currently underway and is expected to last until 1H24 as the middle chart below shows. Meawhile Asia’s major food staple—rice— is continuing to face upward price pressures (see the chart on the right below), made worse by India’s rice export bans.

Climate-related risks are rising with El Nino already underway; Rice prices have surged vis-a-vis other agri products

© 2023 Citigroup Inc. No redistribution without Citigroup’s written permission.

Source: NOAA, EM-DAT, Bloomberg, CEIC, Citi Research

It can be argued that we are now moving into a world of more frequent supply- driven economic shocks. Citi research analysts say fiscal policy will need to play a greater role in mitigating risks from macro shocks going forward. Post the pandemic’s fiscal tool, the debt ratio in Asia-Pacific, is still about 9ppts of GDP higher in 2023F vs pre-Covid.

The Asia-Pacific region is expected to slow from 4.2% in 2023 to 3.9% in 2024F. A key uncertainty is whether China will provide policy support to stabilize the momentum.

Despite seeing the sharpest rise in government debt since Covid in Asia, Citi analysts say macro conditions in China are more conducive than others for an outsized publicly-driven aggregate demand push. But China’s fiscal stimulus is still geared towards infrastructure, rather than supporting excessively cautious households. That could undercut the rebound in China’s consumption, especially with a still fragile real estate market.

Citi analysts say Thailand has the largest projected positive fiscal impulse in the region in 2024F on the back of stimulus measures of the new government.

In Asia-Pacific, outside of those countries that are under severe financial pressure, the report says that China, Australia and Thailand in particular have seen a rise in real effective interest rates on government debt compared to pre-Covid norms.

And among those three, China and Thailand are deviating more versus the previous historical trend in terms of running larger primary deficits.

Primary deficits themselves are still running wider than historical norms (in Thailand, Malaysia, China and, to a less extent, India). Without adequate fiscal consolidation, or structural reforms to boost growth, public debt ratios face upward trend risks, the report says. If not accompanied by improving savings--relative to investments or capital market reforms-- this could constrain its future fiscal buffers, it adds.

For more information on this subject, please see Asia Economic Outlook & Strategy - Does Asia Still Have Sufficient Fiscal Buffers?

Citi Global Insights (CGI) is Citi’s premier non-independent thought leadership curation. It is not investment research; however, it may contain thematic content previously expressed in an Independent Research report. For the full CGI disclosure, click here.