Even as geopolitical tensions keep investors off balance, signs are appearing that certain economic tailwinds may be gathering strength. Take the January US payrolls report. It showed booming job creation, led by the services sectors. That’s a reversal of the early days of the pandemic, when US and global consumers rotated their spending away from services - ostensibly to avoid face-to-face contact - toward goods. Now, as the pandemic broadly recedes, consumers are returning to services.

Citi Research’s Nathan Sheets and team reckon this rotation back to services still has a way to go.

|

Real Consumption by Expenditure |

|

|

|

© 2023 Citigroup Inc. No redistribution without Citigroup’s written permission. |

|

Source: Citi Research, Bureau of Economic Analysis, Haver Analytics |

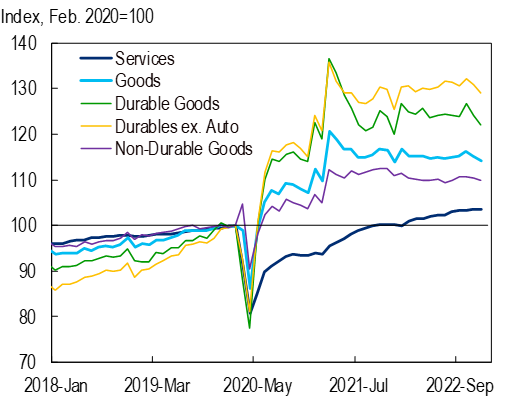

Consistent with this, the chart above displays the major components of consumption, all of which fell sharply early in the pandemic. But goods spending quickly bounced back up, surpassing previous levels. The strength of durables spending, in particular, reflected the rotation away from services discussed above, as well as sizable fiscal stimulus payments to consumers. By mid-2021 the surge in goods had played out with spending on durable goods plateauing at about 25% above pre-pandemic levels and non-durables up 11%.

In contrast, services spending recovered from the pandemic much more gradually, but it has continued to rise through the past 18 months as goods expenditures have leveled off. Services spending matched its pre-pandemic level in the fall of 2021 and is now up a further 4%.

Some of this means that inflationary pressures are currently being driven by services, potentially posing a challenge for central banks.

Much of this is easy to reconcile with some of the key features of Citi Research’s broader economic forecast, which points to relatively desynchronized cycles across the major economies.

Citi Research economists still see “rolling” country-level recessions impacting various countries and regions different times over the next year or so. They also reckon central banks ultimately will win their battle with services-led inflation although it’s a fight that will likely continue through the end of this year, with meaningful signs of improvement emerging only in 2024.

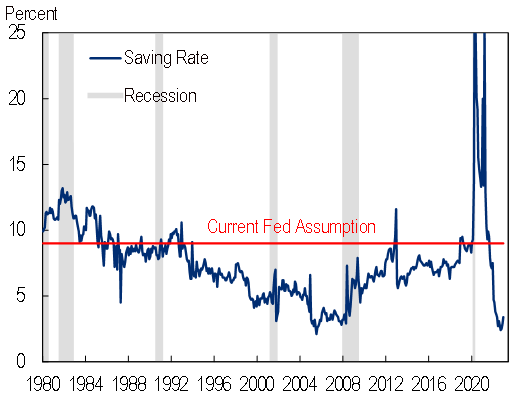

Meanwhile, the US personal saving rate, which surged during the pandemic and remained highly elevated for several quarters, is back in the spotlight.

In recent quarters these funds have been drawn down to support consumption against a backdrop of higher inflation and tightening monetary policy. A new report from Citi Research’s Robert Sockin focuses on the question of how much remains and what that does to the outlook for consumption.

The benchmark estimates for excess saving come from a recent paper by economists at the Federal Reserve. They found that excess savings peaked at around $2.3trn in mid-2021 and are currently around $1.2trn.

|

US Saving Rate |

|

|

|

© 2023 Citigroup Inc. No redistribution without Citigroup’s written permission. |

|

Source: Citi Research, Bureau of Economic Analysis, Haver Analytics |

The amount of “excess saving” on household balance sheets remains a pivotal factor for the US outlook.

The Fed’s estimate assumes households (in the absence of other shocks) would now be expected to save near 9% of their income — almost all monthly saving rates from 1990-2019 were below this level. Less aggressive assumptions for underlying saving behavior raises the Fed’s estimate of excess saving substantially. For example, a framework that puts underlying desired saving in the mid-8% range today increases excess saving to $1.7trn. Saving rates in the 7% range could increase excess saving to near $2trn. That’s to say excess savings could be materially larger than currently believed.

For more information on this subject, please see:

Global Economics - The Surge in Services Spending—Still Room to Run? (10 February 2023)

Global Economics - How Much Firepower Does the US Consumer Have Left? (13 February 2023)

Citi Global Insights (CGI) is Citi’s premier non-independent thought leadership curation. It is not investment research; however, it may contain thematic content previously expressed in an Independent Research report. For the full CGI disclosure, click here.