Covid has changed the way the world uses the internet and the impact of that changing behaviour will continue to reverberate. Here are 11 trends Citi analysts reckon will drive the internet’s development over the coming months and years.

-

The New Normal

How we work, shop, travel, socialize, communicate, consume entertainment (TV, movies, music), work out, order & get meals and groceries delivered, seek legal advice, the list goes on, has moved to digital channels. The recurring theme is the Internet’s ability to consistently reduce friction and provide services that are more convenient than ever before as more offline habits come online.

The Pandemic Has Shifted Consumer Behavior to a New Normal Online |

|

|

|

© 2022 Citigroup Inc. No redistribution without Citigroup’s written permission. |

|

Source: Citi Research, DigitalCommerce360, eMarketer, Comscore, U.S. Dept. of Commerce |

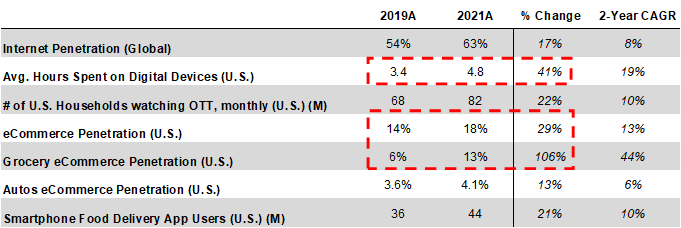

Users now spend ~8 hours / day on all digital devices with ~4.8 hours of those (+30% vs. 2019) via mobile devices (per App Annie’s State of Mobile 2022). Global internet users grew 17% in 2021 compared to 2019 reaching 4.9 billion and representing 63% of the world’s population versus 54% penetration in 2019. While 90% of Americans say the internet has been essential during the pandemic, 40% suggested they have used the internet in new and/or different ways when compared to pre-pandemic usage.

-

The Metaverse and Web 3.0

Citi analysts view the metaverse as a natural evolution of the Web given how immersive, interactive, and diversified the Internet has become and is becoming.

Broadly speaking, Web3.0 (a more decentralized web) and the metaverse bring a sense of presence to the internet through mixed-reality. Within the metaverse, users can interact virtually with one another, share experiences, buy, sell, and trade goods and services, and utilize NFTs for digital ownership of assets.

Given the metaverse is likely to be open source, these newer experiences are likely to be more open and across platforms and the decentralization that follows with Web 3.0 creates multiple opportunities for new technologies.

Citi’s recent GPS report on the Metaverse (Citi GPS: METAVERSE AND MONEY: Decrypting the Future) suggests users could range anywhere from 1 billion—when looking solely at VR handset users—to 5 billion assuming 5G/Broadband access requirements by 2030.

-

Online Advertising

Newer ad units around AR, VR, and video are driving higher overall conversion rates as performance and brand goals merge within campaigns and ad automation via programmatic is adopted more widely. Specifically, Citi analysts note programmatic now accounts for ~90% of display ads with video expected to surpass non-video formats within programmatic (eMarketer).

According to Nielsen’s latest State of Play report, weekly time spent streaming increased +18% Y/Y in February with ~27% of daily time with media via connected devices, underscoring the mix-shift of linear video ads to digital.

In relation to broader macroeconomic risk, larger platforms are likely among the last to feel the impact of a deteriorating macro and among the earliest to recover given the millions of performance advertisers on their platforms.

-

eCommerce

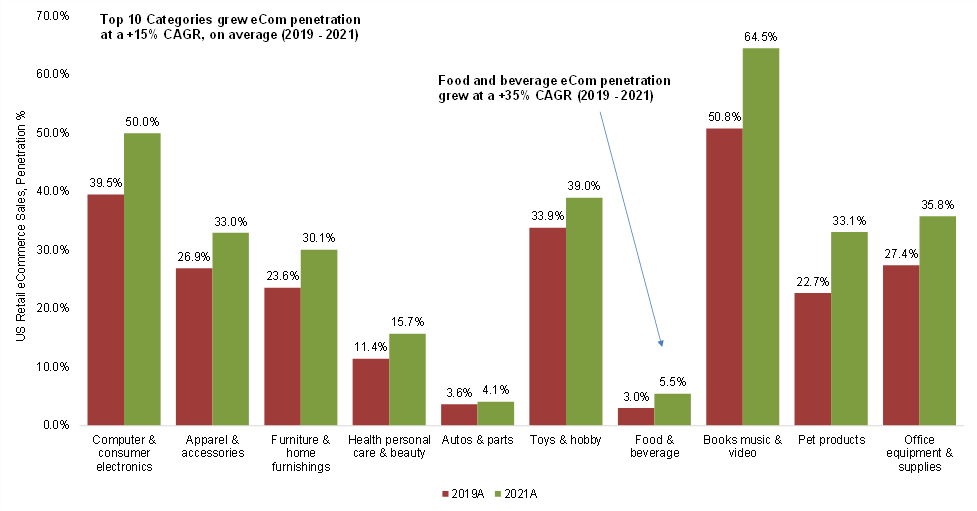

eCommerce is one of the biggest beneficiaries emerging from the pandemic as it has fundamentally changed how consumers buy and transact online.

In 2020, U.S. eCommerce penetration rose 300-400 bps ending at ~18% (compared to ~100 bps gains yearly) and while penetration paused some in 2021 as the economy reopened, eCommerce could reach 25% of total retail sales by 2025 (excluding autos and fuel). Results from Citi’s proprietary survey suggest that 39% of all shopping is likely to be done online, up from 28% pre-COVID, and digital penetration rates among the largest retailers in the U.S. reached ~14% on average in 2021, up from ~7% in 2019.

Over the coming years Citi analysts say the following themes and innovations can lead to further adoption:

1) Social commerce—which adds to the discoverability (and increasingly the transaction) of products; ~64% of social media users surveyed by Accenture said they made a social commerce purchase in the last year

2) Live shopping (aka Live commerce)—popularized in Asia, in particular China, where it accounts for ~10% of eCommerce sales, per McKinsey

3) Fast fashion / made-to-order retail—this is based on fashion trends within social media

4) AR/VR integration creates a shop-before-you-buy approach

5) Geo-location services--as offline/online presence is blurring, and

6) Vertical specific marketplaces -- and also the rise of collectibles and virtual goods.

Major Retail Categories Increased eCommerce Penetration from 2019 to 2021 |

|

|

|

© 2022 Citigroup Inc. No redistribution without Citigroup’s written permission. |

|

Source: Citi Research, eMarketer |

-

The Rise of Quick Commerce

While earlier in its adoption lifecycle, Quick Commerce (“QC”)—where users can order most anything from groceries to alcohol to convenience products and have them delivered within an hour—is a natural evolution of commerce.

The delivery economics of Quick Commerce are challenging. As such, Citi analysts expect the industry to further consolidate around those services that have broad scale, reach, and a more diversified approach to sourcing and delivering goods.

Underlying Quick Commerce’s demand are faster and constantly improving eCommerce delivery times, though the Citi analysts do not necessarily believe 15-minute (really sub-30 minute) delivery times are required.

Key to Quick Commerce success is consumer demand, which looks to be ramping up, with convenience as the driving factor to the point that it can often outweigh the added delivery fees, Citi analysts say.

-

Subscribing for Convenience

While subscriptions are now common, the next wave of subscriptions is likely to be for convenience and service. There is growing demand among consumers for subscriptions that offer savings for higher frequency use. And like other subscription offerings, the net benefit is a more engaged user, increased loyalty, and lower overall churn rates.

The Citi report compares various subscription offerings that cater to convenient on-demand delivery of household items, food, and groceries to consumers.

-

The Travel Rebound and Alternative Accommodations

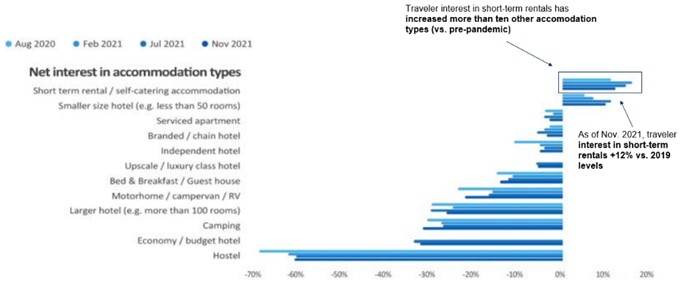

Travel is one of the largest categories in terms of spend with Phocuswright estimating the global travel spending market reached $1.9 trillion in 2020, pre-pandemic.

Perhaps the biggest trend in travel post COVID, Citi analysts say, is the rising demand for alternative accommodations. Alternative accommodations accounted for ~30% of lodging market share in 2020, up from ~16% in 2018 (based on STR/AirDNA data). Alternative accommodations are the preferred property type among travellers surveyed in STR’s most recent traveller survey in November 2021 with interest 12% above pre-pandemic levels.

Traveler Interest in Short-Term Rentals Was 12% Above Pre-Pandemic Levels of Interest (as of November 2021). |

|

|

|

© 2022 Citigroup Inc. No redistribution without Citigroup’s written permission. |

|

Question: Thinking about your attitudes before COVID-19 to how you feel now, how interested are you in the following types of accommodation when going on a leisure trip? Aug 2020 (1,333), Feb 2021 (1,333), Jul 2021 (1,750), Nov 2021 (1,440); Net Result: Difference between ‘More interested’ and ‘Less interested’) |

|

Source: Citi Research, STR, CoStar Group |

-

Enabling Main Street

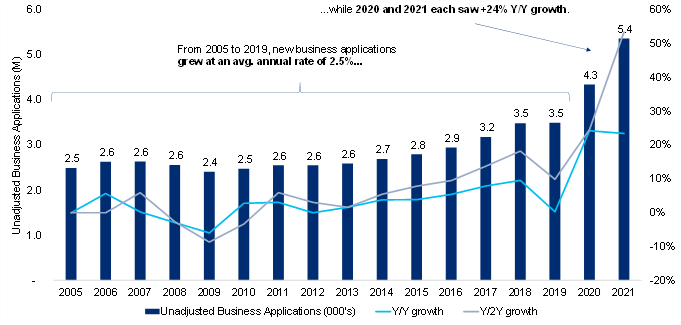

The pandemic demonstrated that every SMB—whether online or off—must have a functional and transactional web presence as consumer behaviour shifted to spending more time online.

The pandemic ushered in a wave of elevated business formations in the U.S. with new business applications +24% Y/Y in both 2020 and 2021 compared to ~2.5% average annual growth between 2005 and 2019, per the U.S. Census Bureau. Continued growth could come from:

-

Up-sell/cross-sell of new products and services;

-

Transactions as more payments solutions transition in-house; and

-

Rise of Partner & Agency Mix relative to Do-it-Yourself SMBs

The U.S. Saw Elevated Business Formations (+24% Y/Y Growth) During the Pandemic. |

|

|

|

© 2022 Citigroup Inc. No redistribution without Citigroup’s written permission. |

|

Source: Citi Research, U.S. Census Bureau |

-

The Cloud Creates Multiple Long-Term Growth Drivers

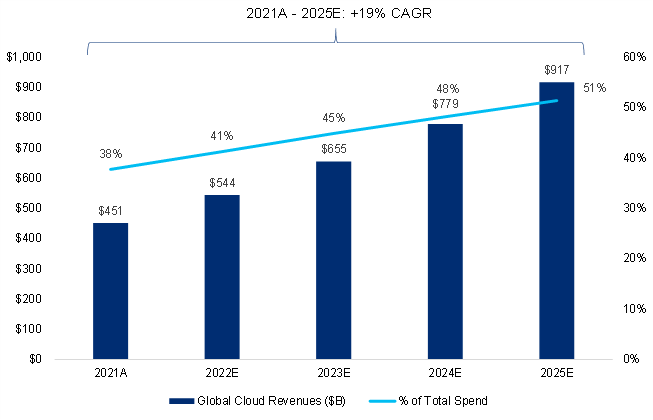

With just 15% of total IT spending worldwide on the Cloud and the broader Cloud market expected to reach ~$917 billion by 2025 (Gartner, Jan. 2022), the shift to the Cloud can be viewed as one of the most important trends in computing—impacting most every sector of the economy. The pandemic accelerated the shift to the Cloud given its more efficient model and as a result more instances were migrated to the Cloud ahead of prior timelines.

Gartner Projects Global Cloud Revenues to Grow to $917 billion by 2025E (+19% CAGR since 2021A) |

|

|

|

© 2022 Citigroup Inc. No redistribution without Citigroup’s written permission. |

|

Gartner Cloud estimates includes spend within enterprise IT spending within application software, infrastructure software, business process services, and system infrastructure markets. |

|

Source: Citi Research, Gartner |

-

International and Eastern European Exposure

International has always been a key source of engagement and revenue for most of the largest Internet platforms with Europe typically the largest region outside of the U.S.

To get a better sense of the potential economic impact of Russia’s invasion of Ukraine across Europe, Citi’s Innovation Lab conducted a survey in early March of 4,000 adults aged 18+ in France, Germany, Poland, Russia, and the U.K. While there is an increasing concern around disposable income, particularly in Poland, when asked about category spend in the next three months, travel was the category most likely to experience an increase in spending across all countries.

-

Assessing the Growing Regulatory Risk

Given the multitude of bills, investigations, and potential break-up discussions in Washington and Europe relating to major internet companies, there is potential ongoing regulatory risk that could impact growth. But engagement continues to grow. Once the bills are passed, Citi analysts say internet companies should be able to operate with less uncertainty regarding the legal and regulatory environment. The full Citi report discusses some of the larger bills and regulatory issues in the U.S. and Europe.

For more information on this subject, please see North America Internet

Citi Global Insights (CGI) is Citi’s premier non-independent thought leadership curation. It is not investment research; however, it may contain thematic content previously expressed in an Independent Research report. For the full CGI disclosure, click here.