Historically, oil companies with surplus capital had two choices. They could spend it. Or they could return it to shareholders. The energy transition makes this more complex. Why? Because there’s more uncertainty over long-term hydrocarbon demand. And, more importantly, there’s greater accountability from oil company stakeholders to decarbonize, or face mounting existential risks.

As such, Citi Research analysts say they expect the energy transition creates the imperative for a third capital allocation bucket know as New Energy, which largely takes two forms: decarbonisation and diversification.

- Decarbonization: This is reducing scope 1 and scope 2 emissions toward net zero in a timely manner. The team suggests these efforts are largely expected by stakeholders now; certainly by 2050 but increasingly 2040. Meaningful progress must be made by 2030.

- Diversification: This is creating new revenue streams not linked to oil/gas prices. Examples include revenue-generating carbon capture solutions, alternative fuels like hydrogen, biodiesel, synthetic methane, and sustainable aviation fuels, as well as renewables projects like offshore wind.

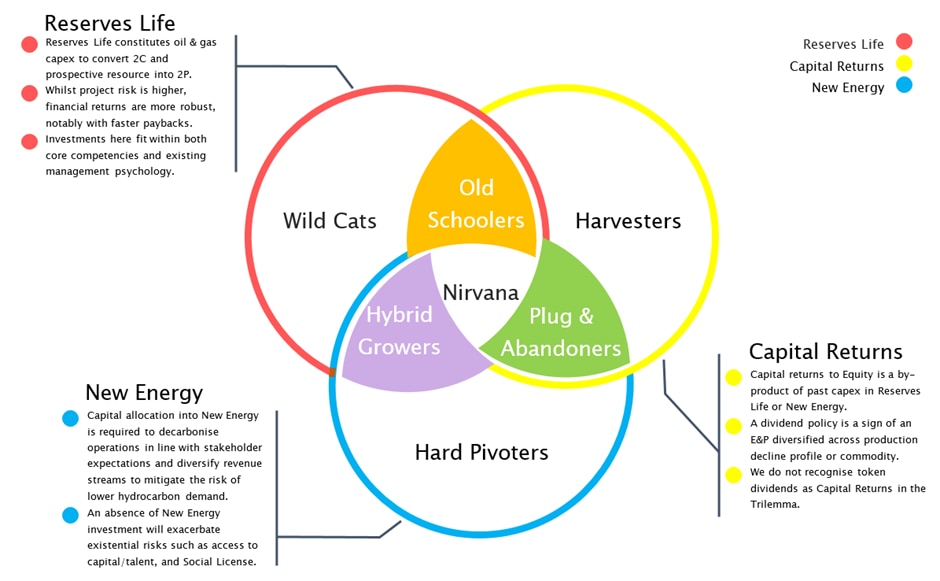

In Citi Research’s Energy Company Trilemma framework, which is illustrated below, companies will develop specific archetypes depending on the mix of spend among each of the three buckets.

Company Archetypes in the Energy Company Trilemma of Capital Allocation

As the energy transition intensifies, we expect company strategies will have to juggle a third pillar of surplus capital allocation: New Energy. A failure to do so would increase the existential risks facing the industry, such as access to capital and talent. Different archetypes can define each strategy.

© 2023 Citigroup Inc. No redistribution without Citigroup’s written permission.

Source: Citi Research

How much spend is enough?

Beyond moral arguments, what is the right level of spend in New Energy to avoid the some of the existential threats laid out briefly later in this piece? Company management, equity, and other stakeholders in these businesses will ultimately need to determine the answer to this question by mid-decade, the authors say. Firm answers are some ways off, but here are some high-level thoughts from the team on this:

- For decarbonizing operations, the analysts suggest companies target scope 1 and 2 emissions being net zero by 2040.

- For those companies that do want to transition, the analysts suggest they should spend enough capital in the 2020s to develop capabilities in the New Energy value chain. They say green “molecules” are likely a better pathway than green “electrons” for oil & gas companies given their existing technical capabilities and cultures are better suited to this.

- For companies that do not have the scale or corporate culture to transition, the analysts present an argument that these companies should try to be acquired or enter into “harvest mode”.

What happens if companies get their trilemma capital allocation wrong?

1. Existential risks…

In the absence of adequate investment in New Energy, existential risks will become more pronounced for several stakeholders, including:

- Lenders. The provision of credit will reduce and/or become more expensive.

- Equity investors. A company that isn’t investing in the 2020s some capital in New Energy will unlikely be able to transition.

- Staff and future talent. Staff that do not believe enough New Energy spend is being made will become disengaged as there is less “purpose”. Staff will need to be paid more for retention in these types of businesses. Graduates will increasingly work elsewhere.

- Customers. Utility companies and trading houses will want assurances that the hydrocarbons they’re burning are being mitigated on a scope 1 and scope 2 perspective based on local requirements.

- The community. Social license to operate will be increasingly questioned.

- Governments. Regulatory uncertainty will persist and become greater if the sector overall fails to allocate enough capital to New Energy.

- Insurers. Insurance over specific projects may become unavailable and/or premiums increase, at a time when asset lives are becoming increasingly old, and therefore risks earnings primarily through asymmetric downside risk.

2. …which leads to financial and valuation risks…

The analysts say it’s very difficult to determine the financial impacts from the existential risks coming to fruition. But some things that could happen in theory:

- Higher Opex: Spreads on corporate debt increase as the pool of lenders reduces. Insurance premiums increase firstly as reinsurers reduce sector coverage, eventually followed by general insurers. Salaries to attract talent increase.

- Contracting ROIC: Limited access to financial leverage (debt), notably project finance, or reducing debt/equity ratios.

- Production: More accidents, lower reliability.

- Higher taxes: The industry attracts government ire, reflected through taxes and carbon pricing.

- Growth project risk weights: Less social license increases project execution risk.

3. … which may lead to listing risks

- Privatisation: Companies that do not have the capabilities to transition would face higher risks of being taken private.

- Dual listings:The risk of stock exchange arbitrage becomes greater on the basis of differing tolerances for transitions risks.

The full report goes on to describe how remuneration is aligned with the trilemma and much more with a focus on Australian oil companies. To read it in full, if you are a Velocity subscriber, please see Australia Oil & Gas - The Energy Company Trilemma: Investing in the Transition, published on 27 June 2023.

Citi Global Insights (CGI) is Citi’s premier non-independent thought leadership curation. It is not investment research; however, it may contain thematic content previously expressed in an Independent Research report. For the full CGI disclosure, click here.