Here’s the current state of play with regard to US regulation of crypto assets.

Stablecoins

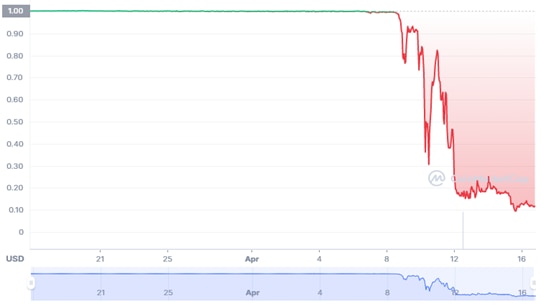

Recent cases of de-pegging and collapse demonstrate the risks of algorithmic stablecoins. The potential for knock-on impacts in short-dated markets like commercial paper is likely to bring the ecosystem under more scrutiny from regulators that prioritize financial stability.

Algorithmic stablecoins, unlike more traditionally collateralized stablecoins, are not backed by reserve assets. Instead, they use various protocols and digital arbitrage rules to ensure pegging to the USD, which makes them riskier and even more difficult to regulate than traditional stablecoins.

In testimony to the House Financial Services Committee, US Treasury Secretary Janet Yellen raised concerns over stablecoins and called for unified federal regulation and comprehensive frameworks.

Given their importance in the crypto trading ecosystem, increased risk of “runs” and de-pegging, and their (growing) interconnectedness with the traditional financial system, stablecoins are likely to be a primary focus area for US policymakers this year.

While US federal regulators had been focusing only on traditional stablecoins, as evident from the President’s Working Group (PWG) report published in 4Q’21, the recent breakdown is likely to bring attention to the algorithmic space as well – potentially leading to a co-mingling of stablecoin oversight broadly. Whether stablecoins will be regulated as insured depository institutions, as proposed by the PWG report, or as money market funds, as proposed by some industry players, remains unclear.

Recent instability in the synthetic stablecoin market suggests these products will be a target for more stringent oversight (including transparency and disclosure measures). Moreover, recent developments might prompt the US government to pay more heed to creating its own CBDC (central bank digital currency) in order to eliminate the need of a number of privately-issued stablecoins (albeit privacy concerns and many other issues have been raised by opponents of such a move).

On that note, even the naming conventions of private stablecoins could come into question, as the marketing of these products, and several de-peggings, garners more scrutiny.

Figure 1. TerraUSD lost its peg to the USD and crashed in value |

|

|

|

© 2022 Citigroup Inc. No redistribution without Citigroup’s written permission. |

|

Source: Citi Research, CoinMarketCap |

SEC/CFTC Update

In the absence of expansive US federal legislation for digital assets, regulatory agencies continue to use enforcement actions as a regulatory tool. Since 2017, the SEC has brought more than 80 digital asset-related enforcement actions and levied more than $2Bn in fines.

The SEC is adding 20 officials to its Crypto Assets and Cyber Unit, the enforcement arm which is responsible for protecting investors in crypto markets and from cyber-related threats, almost doubling the size of the sub-unit. The announcement conveyed the agency’s intention to broaden its oversight by covering six major areas: (1) crypto asset offerings; (2) exchanges; (3) lending and staking products; (4) decentralized finance (DeFi) platforms; (5) non-fungible tokens (NFTs); and (6) stablecoins.

Although the headlines are focused on the enforcement actions taken by the SEC, the agency’s work on the rulemaking front is also gathering steam.

President Biden’s Executive Order

President Biden signed an Executive Order on Digital Assets in March 2022, which calls for coordinated action among different agencies and speaks to the urgency in Washington DC to implement some regulatory framework. The order directs federal authorities to assess risks and prepare frameworks, with reports due in 90-210 days, corresponding to seven key areas outlined below:

-

Consumer/Investor/Business Protection – directs the Department of the Treasury and other agencies to assess and develop policy recommendations. Also encourages regulators to ensure sufficient oversight.

-

US and Global Financial Stability and Systemic Risk – encourages the Financial Stability Oversight Council to identify and mitigate systemic financial risks and develop policy recommendations.

-

Illicit Finance and National Security Risks – directs the focus of coordinated action across all relevant agencies to mitigate these risks. Also directs agencies to work with allies and partners to ensure international frameworks, capabilities, and partnerships are aligned and responsive to risks.

-

U.S. Leadership in Technology and Economic Competitiveness – directs the Department of Commerce to establish a framework to drive US competitiveness and leadership in digital asset technologies.

-

Equitable Access to Safe and Affordable Financial Services – directs the Secretary of the Treasury, working with all relevant agencies, to produce a report on the future of money and payment systems.

-

Technological Advances and Responsible Development and Use – directs the US Government to take concrete steps to study and support technological advances.

-

US CBDC – directs the US government to assess the technological infrastructure and capacity needs for a potential US CBDC in a manner that protects Americans’ interests. Also encourages the Fed to continue its research, development, and assessment efforts for a US CBDC.

Comprehensive regulatory frameworks are expected to take time to develop, probably moving slower than the evolution of the asset market. However, recent policymaker statements, including Treasury Secretary Yellen’s testimony, suggest that there’s a new urgency for regulation, especially for stablecoins. For more information on this subject, please see North America Commodities - Crypto Regulation View: What's in store for your (digital) wallet?

Citi Global Insights (CGI) is Citi’s premier non-independent thought leadership curation. It is not investment research; however, it may contain thematic content previously expressed in an Independent Research report. For the full CGI disclosure, click here.