Technology has become an integral part of our daily lives in ways that would have been unimaginable just a few years ago. We interact, bank, shop and entertain ourselves on our phones. When we download a new app or install a new program on our desktop, we rarely take time to read a user manual; many solutions no longer even offer one. Instead, our expectation is for solutions to be straightforward, intuitive and adaptive to our way of using them.

Unfortunately, that has rarely been the case when it comes to banking solutions for treasurers in small and mid-sized companies. Many platforms have suffered from underinvestment relative to those for consumer and larger corporates. Often clients have been dissatisfied with their online banking platform, finding the user experience outdated, confusing, inflexible and unnatural. Moreover, many platforms are disjointed, having been added to incrementally over many years, with little attention paid to consistency or workflow.

A new commitment and a fresh way of thinking

As part of its digital transformation, in the past two years Citi Commercial Bank has committed significant investment to its digital channels in order to change how clients interact with the bank and to improve their overall experience. Citi Commercial Bank’s new approach to solution design is informed by the intuitive way we experience technology today in our daily smartphone and desktop interactions. At the heart of this reimagining is humancentered design.

In the past, bankers and product teams got together to try to figure out clients’ needs; clients were actually only involved at a late stage of development. Inevitably, bank experts and technologists – who were intimately familiar with the functionality they had developed – saw solutions in a different way than clients. Indeed, when clients were involved in testing a new solution and problems were encountered, the usual response was to suggest client training.

Human-centered design upends this way of thinking. Instead of requiring clients to be trained, Citi is ensuring that solutions work in an intuitive and easily understandable way for clients from day one. Functionality and capabilities remain critical to the value that Citi Commercial Bank solutions offer to clients. But there is now a realization that the experience of how clients interact with a solution is equally important. If a tool is hard to use, clients simply won’t use it.

Putting ourselves in clients’ shoes

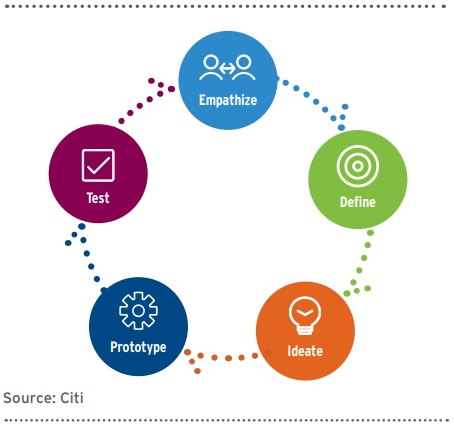

Put simply, human-centered design is about getting inside the heads of clients so that their needs are understood, and functionality and workflows are designed in ways that make it easy for clients to achieve their goals. To do that, it is important not to think of solutions in isolation. They should be seen within the context of the broader digital ecosystem that treasury or the company is part of – and should seek to fit in seamlessly with clients’ existing ways of working.

To create a human-centered design mindset, Citi has undergone a number of changes. One of the most important has been around ensuring the team has an agile mindset. By shifting to a product mindset rather than the traditional technology development and implementation focus that previously led solution development, Citi Commercial Bank has made a big leap forward in ensuring that clients’ real priorities – in the fullest sense – drive how solutions function.

What does this mean in practice? A good example is to think of how the bank might respond to a client request for a new type of report. In the past, there was a tendency across the industry simply to address this query (should a sufficient number of clients request the same type of functionality). However, such a response fails to fully understand what motivated the client request, why they need this functionality, or how they plan to use it. Over time, this incremental approach to solution functionality ultimately leads to complex workflows that require extensive instruction and practice to be used effectively. While long-term users who are familiar with a solution may understand it, the learning curve for new users can be formidable.

A step change in mindset and technology

As well as ensuring an agile skill set, organizational change is an important driver of Citi Commercial Bank’s digital transformation and the bank’s pivot to focus on addressing clients’ real challenges in a timely and targeted manner. Regardless of the extent and quality of client research, it has little value if it cannot be turned into a change in product functionality in a reasonable timeframe. The adoption of agile methodology is crucial in this regard.

Rather than working in distinct silos on long-term projects, Citi Commercial Bank is now organized into smaller, nimbler teams that are assembled to address a specific user need. These teams can respond faster so that solutions reflect clients’ immediate priorities. By breaking projects into smaller components, agile also allows teams to test more easily (and learn from mistakes) in a way that is not possible with more investment-intensive long-term solution development projects. Through a series of experiments that take place early on, the product team is able to discard what does not work and feel confident that what is ultimately ‘shipped’ to clients is the right solution for the right problem.

Citi Commercial Bank’s adoption of agile methodology is mirrored in its approach to technology. For instance, microservices, an architecture where applications are arranged as a collection of loosely coupled services, is essential to enabling the rapid implementation of functionality or changes to how users interact with the solution. An Application Programming Interface (API)- first approach facilitates regular updates and evolutions without requiring a fundamental redesign of a solution. It will also address a growing demand from clients to plug these services directly into the tools they are already using, including accounting platforms, Treasury Management Systems, and Enterprise Resource Planning (ERP) systems, without even needing to log into their bank’s site.

Deeper engagement with clients

Human-centered design has spurred a move away from thinking about clients as a homogeneous group. Traditionally, banking platforms have been built around a standard client journey and requirements. However, each company has many different roles, which have different needs and priorities.

By introducing a more responsive design, Citi Commercial Bank can now create persona-based experiences that are customized to reflect the necessities and ambitions of distinct groups of users, regardless of the device they’re using. For example, a Chief Financial Officer (CFO) persona might prioritize high-level information on their phone and functionality such as forecasting or planning, while an Accounts Payable (AP) or Accounts Receivable (AR) analyst will need immediate access to more granular information and different artifacts that reflect the people they interact with.

More generally, human-centered design ensures that clients’ voices are heard at every stage of the development or redesign process. One way this happens is through co-creation. Typically, this initially involves internal partners, such as relationship managers or treasury consultants, whose experience and detailed understanding of clients’ needs are leveraged to devise hypotheses on clients’ personas and needs. A user experience team then interviews clients before creating a wireframe (a visual guide that represents the skeletal framework of a solution). This is then tested with the clients: in the past, such opportunities were often treated like a demo or training session; now clients drive the process and are simply presented with the wireframe so that their interactions can be observed and key use cases developed. Clients might then suggest possible improvements, which help undercover client needs, and are subsequently incorporated before the cycle of testing and improving occurs again. After a few iterative rounds, the solution is usually ready to go to pilot, though interaction with the original test clients continues (especially if there are low scores in the pilot). The client experience, including their interaction with specific features and key journeys, is tracked throughout via a dedicated metric tracker.

After piloting new or redesigned solutions, Citi Commercial Bank proactively seeks to enroll clients that could benefit from the new feature (based on their transactions or existing work patterns) rather than waiting for clients to request functionality.

Conclusion: Human-centered is already delivering benefits

Citi Commercial Bank’s adoption of human-centered design is all about making it easier for clients to achieve their objectives and interact with the bank – either via the online banking channel on their desktop or mobile device or through their ERP system. However, Citi Commercial Bank accepts that while redesigned solutions undoubtedly improve user experience, they nevertheless could require significant change on the part of clients. Legacy solutions take a long time to learn to use effectively: often clients are reluctant to replace a familiar process with a new one – however much simpler it promises to be.

Citi Commercial Bank is therefore committed to taking time to support clients. If Citi Commercial Bank is to succeed in its mission of being the best for its clients, it must clearly explain the evolving functionality of CitiBusiness® Online and other solutions, the ease of adopting new ways of interacting with Citi, and the significant efficiency and convenience gains on offer.

The adoption of agile methodology, new approaches to technology such as microservices, the hiring of new talent and deeper engagement with clients are key components of Citi Commercial Bank’s digital transformation. These changes are well underway: for instance, over 70 client interviews on topics as diverse as ERP integration, report building, remote check deposit, wires, entitlements and real-time payments, have already been conducted this year. While interviews are focused on the nuances of clients’ needs, the underlying goal – and product teams’ specific mandate – is always to make it easier and faster for clients to work with Citi Commercial Bank.

The quantitative and qualitative benefits of this approach are already evident: users require significantly fewer clicks to complete their tasks—such as login and information reporting-- than in the past, and feedback from clients about the redesign of CitiBusiness Online is overwhelmingly positive. Clients appreciate Citi Commercial Bank’s deeper engagement with their needs and being considered as co-creation partners on this exciting journey ahead, and this is just the beginning.