The normal progression of a currency crisis is that an unforeseen event triggers a sudden stop to capital inflows. Because financial markets react faster than economies — or at least that is the theory — exchange rates depreciate much more initially than would be implied by underlying fundamentals. That is, they overshoot and are typically on the rebound (in real terms) before the economic cycle hits its trough.

The first part of this sequence played out as expected in March 2020 when the OPEC+ meeting (the 14 members of OPEC and 10 other non-OPEC members) failed to agree on production cuts necessitated by the emerging pandemic. But two factors quickly changed the situation. Firstly, the Fed called a halt to the dollar’s advance within just a few weeks. This would very rarely happen in the event of an individual-country currency crisis (the Mexican peso crisis of 1995 is an exception). However, in this instance it was deemed necessary given the global nature of the crisis. Secondly, the downturn in economic activity was much faster and deeper than in previous recessions because of containment measures designed to slow the spread of the virus. The coordinated downturn in activity then prompted a dramatic improvement in the current account balances of many countries, meaning that they were no longer nearly as susceptible to a sudden halt of capital flows.

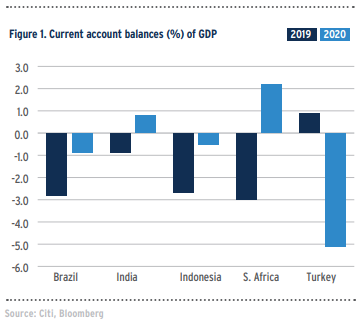

Consider the five emerging markets illustrated in figure 1, which were dubbed the “fragile five” in 2013 due to concerns about their current account deficits in the wake of the “taper tantrum”. The latest data shows Brazil’s current account deficit at its lowest level in 13 years while its central bank has forecast a surplus this year; South Africa has posted its first surplus since 2002 and the largest year-toyear improvement since 1985; India has a surplus for the first time since 2003; and the reduction in Indonesia’s deficit represents the largest shift since the East Asian crisis of 1998. There is one exception: Turkey’s deficit has risen to 5.1% of GDP in 2020, just over the 5% level normally seen as critical. Turkey’s balance of payments deterioration is just one facet of a broader crisis for the country, however.

The relief provided by the Fed, and the consequent improvements in the balance of payments for the “fragile five”, are inherently short term in nature. The pandemic may be winding down in some countries, but many are still facing record numbers of infections and deaths as well as new non-pharmaceutical interventions (NPIs — the term now used to cover the wide variety of containment measures adopted by governments). Debt burdens, whether internal or external, have risen sharply to levels previously considered unsustainable, and the interest rate pendulum has started to reverse. Almost all countries have called a halt to the interest-rate cutting cycle, and Brazil, Russia and some other countries have started to raise rates. Does this mean that the currency crises expected last year have merely been postponed rather than prevented?

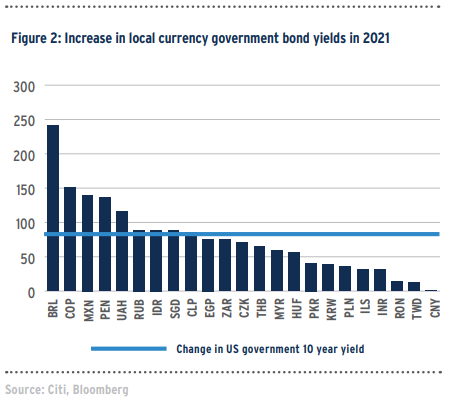

Another “taper tantrum” The evidence so far is encouraging in terms of the ability of the “fragile five” and other emerging market countries to withstand the impact of higher US rates. Local currency-denominated bond yields have increased for a broad array of emerging markets, with a number of central banks taking steps to try to moderate or prevent any increases. Some bond auctions have failed as central banks have been unwilling to accept higher yields, but, as illustrated in figure 2, the overall increase in yields this year has been quite moderate. For more than half the countries in the sample, the increase in 10-year yields has been less than in the US 10-year yield. Obviously, there are a number of countries with higher bond yields, which have either defaulted, or which face major financing problems (e.g., Argentina and Ecuador), but these countries had problems well before US yields started to increase. Overall, this is not an environment that would trigger destabilizing exchange-rate moves.

Of course, higher interest rates are only one component of the current environment. As noted earlier, debt burdens have risen to levels previously considered unsustainable. The IMF, in its semiannual World Economic Outlook released in April, 2021 estimated that government debt as a percent of GDP rose in 168 out of 187 markets between 2019 and 2020, the inevitable result of increased government spending, reduced taxation, and the slump in economic activity.

Whether debt is a significant burden today depends on whether it was a significant burden previously. In the case of Brazil, the debt ratio has long been a matter of concern. The same is true for South Africa, with a debt burden projected to increase this year to more than 80% of GDP. Even where countries have lower deficits — e.g., Colombia at 62.8% in 2020 — their debt burden may be viewed as potentially problematic by the main ratings agencies given longstanding concerns.

What do we need to watch?

To date, emerging markets — and emerging market currencies — have weathered the increase in US bond yields and the increase in government debt better than expected. However, the outlook will depend on the path of the pandemic: how fast can vaccines be deployed, to what extent new waves of infections develop, whether variants of concern are resistant to existing vaccines, how long will existing vaccines be effective, and how policymakers respond.

In those countries now facing new waves of infections and deaths, such as Brazil, pressure is building for a further relaxation of fiscal policy in order to cope with the dislocation of economic activity. The IMF’s April 2021 World Economic Outlook further revised upward its forecast for global economic growth following an upgrade in January. But some countries are now being obliged to lower their 2021 GDP growth forecasts and push back the likely timetable for an easing of NPIs. The return to normal in terms of budget deficits and debt burdens will similarly need to be extended, thereby increasing the risk of exposure to higher global interest rates and a taper tantrum.