Working capital in an evolving environment

Staying nimble amid rising interest rates and an evolving inflationary environment means vigilant working capital management and ensuring ready access to liquidity at efficient rates. Managing rising interest rates and high inflation has been top of mind for treasurers and corporate treasury teams as many seek solutions to minimize the impacts of margin compression.

The Fed increased rates by 25bps on March 22 with the Bank of England following suit on March 23. In his March 22, 2023 press conference, Federal Reserve Chairman Jerome Powell stated, “The process of getting inflation back down to 2 percent has a long way to go and is likely to be bumpy” and had the view that tightening credit conditions could quell the need for future hikes1.

Amid a decrease in consumer spending, inventory management has become less efficient over the last two years due to a shift from “just in time” to “just in case” as a tool for countering supply chain disruption. Sellers are tasked with holding more inventory financed at their own cost of capital on behalf of their customers. Credit spreads between investment grade (IG) and high yield (HY) rated companies widened at the outset of the Fed’s hiking cycle and underscored the importance of sellers having access to liquidity at efficient rates.

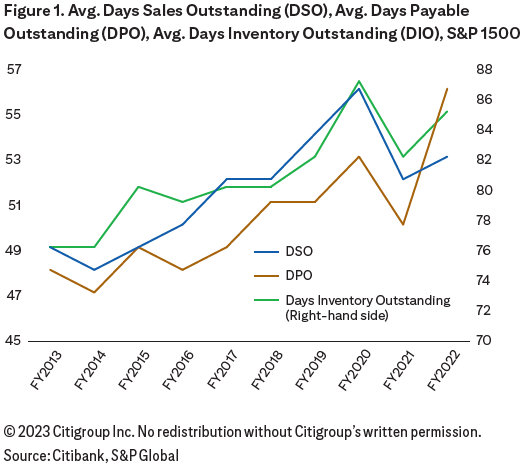

Corporates have focused on working capital for the last 15+ years and are very active in managing payment terms. Days Payable Outstanding (DPO) has lengthened by an average of nine days since 2014 for S&P 1500 listed companies (see chart below). Exiting the pandemic, companies have found ways to lower Days Sales Outstanding (DSO) by launching receivable finance programs and participating in supply chain finance programs to counter buyers requesting longer payment terms.

1 FRB, Chair Powell’s Press Conference, 2023

How Citi can support sales and customer resiliency

while managing DSO & credit exposure

With the varied financial conditions over the last three years, customers are seeking flexible and longer payment terms. Sellers can leverage accounts receivable financing to potentially inject liquidity into sales distribution channels while managing DSO. For example, today a large consumer and industrial goods manufacturer utilizes a structured AR finance program in addition to commercial paper to provide their business with liquidity. Structured accounts receivable (AR) portfolio financing could be an efficient working capital optimization tool to reduce DSO, while allowing longer payment terms for strategic customers.

Continued management of working capital

As noted after the 2008 Financial Crisis, remaining vigilant with working capital will help stabilize operations during periods of crisis and accelerate recovery and growth post crisis. Today, Citi has many mature Trade and Working Capital solutions already in place and is well positioned to help corporates navigate these turbulent times.

IRS Circular 230 Disclosure: Citigroup Inc. and its affiliates do not provide tax or legal advice. Any discussion of tax matters in these materials (i) is not intended or written to be used, and cannot be used or relied upon, by you for the purpose of avoiding any tax penalties and (ii) may have been written in connection with the “promotion or marketing” of any transaction contemplated hereby (“Transaction”). Accordingly, you should seek advice based on your particular circumstances from an independent tax advisor.

This communication is provided for informational purposes only and may not represent the views or opinions of Citigroup Inc. or its affiliates (collectively, “Citi”), employees or officers. The information contained herein does not constitute and shall not be construed to constitute legal, investment, tax and/or accounting advice by Citi. Citi makes no representation as to the accuracy, completeness or timeliness of such information. This communication and any documents provided pursuant hereto should not be used or relied upon by any person/entity (i) for the purpose of making regulatory decisions or (ii) to provide regulatory advice to another person/entity based on matter(s) discussed herein. Recipients of this communication should obtain guidance and/or advice, based on their own particular circumstances, from their own legal, investment, tax or accounting advisor.

Any terms set forth herein are intended for discussion purposes only and are subject to the final terms as set forth in separate definitive written agreements. This presentation is not a commitment or firm offer and does not obligate us to enter into such a commitment, nor are we acting as a fiduciary to you. By accepting this presentation, subject to applicable law or regulation, you agree to keep confidential the information contained herein and the existence of and proposed terms for any Transaction.

We are required to obtain, verify and record certain information that identifies each entity that enters into a formal business relationship with us. We will ask for your complete name, street address, and taxpayer ID number. We may also request corporate formation documents, or other forms of identification, to verify information provided.

Certain Services and/or products mentioned in this communication may contain provisions that refer to a reference or benchmark rate which may change, ceases to be published or be in customary market usage, become unavailable, have its use restricted and/or be calculated in a different way. As a result, those reference or benchmark rates that are the subject of such changes may cease to be appropriate for the services and/or products mentioned in this communication. The services and/or products mentioned in this communication reflect Citi’s service and/or product offering at the date of communication but this may be subject to change from time to time.

We encourage you to keep up to date with the latest industry developments in relation to benchmark transitioning and to consider its impact on your business. You should consider, and continue to keep under review, the potential impact of benchmark transitioning on any existing services and/or product you may have with Citi, or any new services (you avail) and/or product you enter into with Citi. Citi does not provide advice, or recommendations on the suitability of your service and/or product choice including with respect to any benchmark transitioning on any existing service and/or product you have with Citi. You should obtain professional independent advice (tax, accounting, regulatory, legal, financial or otherwise) in respect of the suitability of your service and/or products in light of benchmark transitioning as you consider necessary.

The services and/or products mentioned in this communication reflect Citi’s service and/or product offering at the date of communication, but this may be subject to change from time to time.