This goes beyond the shift in energy use across power generation, transportation, industrials and agriculture, and the need to improve buildings/infrastructure efficiency and curb fugitive emissions. For households, businesses, and policymakers, the questions are how big and how persistent could ‘greenflation’ become, and how tolerable it is politically?

|

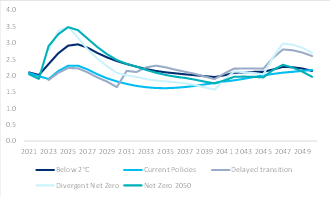

US Inflation Projections by NGFS Models (June 2021 Version) – Under Selected Climate Scenarios |

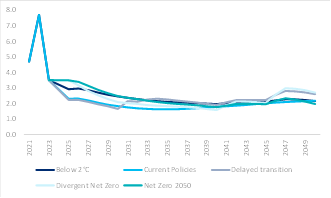

US Inflation Projections with Short-term Citi Forecasts Superimposed for 2021-23, Reverting to NGFS Projections 2024 Onwards |

|

|

|

|

© 2022 Citigroup Inc. No redistribution without Citigroup’s written permission. |

© 2022 Citigroup Inc. No redistribution without Citigroup’s written permission. |

|

Source: NGFS, Citi Research |

Source: NGFS, Citi Research |

Reducing greenhouse gas emissions to net zero by mid-century is a herculean task that requires no less than a complete overhaul of the global economy. Citi analysts estimate some $3-5+ trillion annually of investment is required to do this, across power generation, transportation, industry, buildings, and agriculture. These investments would go into a range of activities: energy efficiency and process changes; heat pumps; wind, solar and batteries; electric vehicles and infrastructure; biofuels; hydrogen and ammonia, to name just a few.

Many of these technologies remain expensive, and someone has to pay — often consumers. Not acting has its own costs, though, in terms of the damaging impacts of climate change.

|

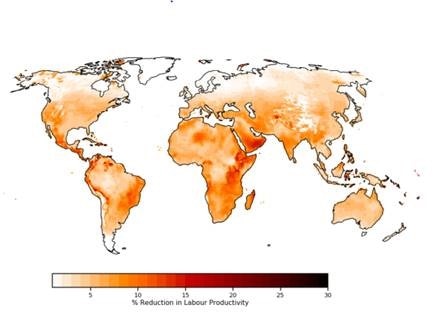

Climate Change Impacts on Labor Productivity at 3°C Global Warming |

|

2100 compared to 1986-2005 |

|

|

|

© 2022 Citigroup Inc. No redistribution without Citigroup’s written permission. |

|

Source: Citi Research, NGFS technical documentation |

|

|

The endgame is likely eventually to be ‘greendeflationary’, say Citi analysts, just as the rest of this decade looks likely to be inflationary.

Beyond ‘transition risks’ related to ‘greenflation’, physical risks could be increasingly impactful and inflationary, especially physical risks associated with accelerating climate change itself.

The World Meteorological Organization (WMO) is forecasting more droughts, more wildfires, more rains, more hot weather, more cold weather, and more sea-coast erosion over the next few years, depending on location. These physical risks can be highly costly, whether directly or indirectly. They can have a direct impact on crops and food prices. But they can also affect forests, buildings, capital stock in infrastructure and energy systems.

Over time, more intense near-term transition activities should reduce the impact of future physical risks.

Technological wildcards could create wildly different new scenarios, too, including some more optimistic ones. Breakthroughs such as advanced nuclear and geothermal, for instance, could mean structural breaks in cost structures of green technologies which would mean cheaper clean energy — a more classical “positive supply shock” to energy and the global economy. Ongoing innovation and R&D activity is important to support this, but the allocation of investment between this versus climate mitigation and climate adaptation capacity build-out will remain a tricky portfolio question for policy makers.

Work to do

To achieve a net-zero future scenario, it looks like the US would need to invest approximately $1.6tn annually over the next several decades. Currently, US companies and major financial institutions are investing nearly $200bn per annum into the energy transition. On the assumption of a 35% CAGR, reaching the minimum net-zero threshold of $1.6tn would take nearly a decade, without accounting for higher inflation and recurring deficit accruals. The net-zero accrual deficit totalling $14tn post-2032 would require an additional decade to overcome. In summary, say the Citi analysts, the US net-zero transition looks more on track for a 2060-65 timeframe at current trends, a decade after announcement commitments for 2050.

The full Citi report looks in depth at the transmission mechanisms from climate change to inflation and at the upside and downside risks to medium-term growth and upside risks to inflation. Read here: Global Commodities - Managing ‘Greenflation’ in an Uncertain World.

Citi Global Insights (CGI) is Citi’s premier non-independent thought leadership curation. It is not investment research; however, it may contain thematic content previously expressed in an Independent Research report. For the full CGI disclosure, click here.