With China’s property sector facing increasing challenges, policymakers are trying to kick-start the country’s property sector. How might those moves impact the property supply chain?

The Citi Research report says that China’s mid-year Politburo meeting brought further confirmation that a “policy trough” is now in the past, leaving all eyes on policy delivery and the subsequent impacts of those policies.

In assessing whether China will meet its 2023 growth target of ~5%, the Politburo admitted “new difficulties and challenges” due to insufficient domestic demand, operational difficulties at some companies, risks in key areas, and external complications.

The authors note that the policy mode has been shifting from “wait and see” toward easing, with leadership delivering a modest stimulus package with a focus on the property sector but so far avoiding a “bazooka” stimulus.

At its midyear meeting, the Politburo did not mention special central-government bond issuance, a topic of widespread recent discussion, and it gave no hints about using consumer vouchers to spur household sentiment. But the authors also note that the Politburo pledged to “adapt to the new situation after major changes in the supply-demand relationship in the property market.”

So, what actions might be expected going forward?

The authors point to the third quarter as a period of potentially intensive policy actions, with important signals to watch for including policy rate cuts; accelerated issuance of government bonds; property easing at the local level, particularly in top-tier cities; and local government debt solutions.

The Property Sector Supply Chain

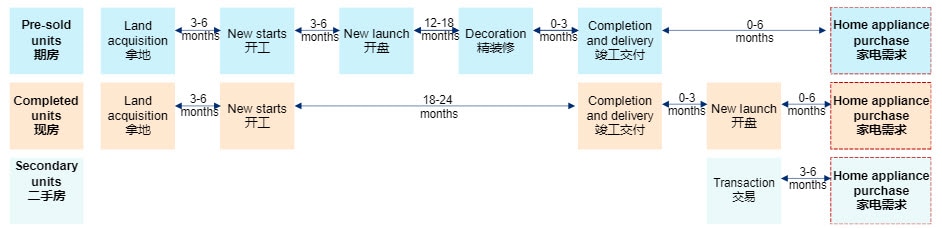

The Citi Research report also delves into how China’s property sector and its supply chain could recover. It notes that a pickup in demand could take six to nine months to develop, a lag compared with previous cycles and one attributed to macro uncertainties.

Replacement demand on shortened replacement cycle to mitigate impact of waned new home-related demand upon normalized property GFA completion in 24-25E

© 2023 Citigroup Inc. No redistribution without Citigroup’s written permission.

Source: Citi Research

The authors also discuss the sectors that make up the property supply chain: Banks, Home Appliances, Industrials, Materials, and Property.

In the Banks sector, impact is expected to be mixed given only a mild recovery in mortgage-loan growth and guidance from the People’s Bank of China to reprice down existing mortgage rates.

The authors expect increased purchases in the Home Appliances sector, driven by replacement demand (on a shortened replacement cycle) given more supportive government policies to boost general consumption, as well as demand for both basic and upgrade housing. That stronger replacement demand, the authors say, should mitigate the impact of a fall in new home-related demand upon normalized property GFA completions in 2024 and 2025.

For Industrials, the authors expect supportive policies to stimulate demand in industrial verticals such as building materials, upstream components for home appliances and home furniture, and renovation.

In Materials, given still-weak property investments, the benefit to demand is seen as uneven as property stimulus takes time to translate into real demand.

For Property, the authors see annual demand as still on a gradual downtrend despite the positive policies. Unlike the 2017 cycle, they note, it could take three to six months for policies to pass through, as upgrade and basic demand hinge on job/income expectations and pre-sales delivery. Supply is also a constraint given weak land sales and new starts in 2022 and the first half of 2023, but corporates are still reluctant to take on new investments due to liquidity concerns and a balance sheet recession. That said, the authors add, the lack of new home supply in the second half of this year and marginally better demand would boost secondary home transactions, and by extension, lift home appliances and the renovation business.

The full Citi Research report, published on 14 August 2023, also includes in-depth examinations of each sector. It is available to Velocity subscribers here: China Property Supply Chain: Policies Turn Supportive, Take Novel Look at Opportunities Across Sectors.

Citi Global Insights (CGI) is Citi’s premier non-independent thought leadership curation. It is not investment research; however, it may contain thematic content previously expressed in an Independent Research report. For the full CGI disclosure, click here.