Antibody Drug Conjugates

A new Super-Sector Analysis from a Citi Research team led by biotech analyst Yigal Nochomovitz offers an overview of antibody conjugates (ADC), which have become critical weapons in the war against cancer. ADCs combine the potency of chemotherapy with the precise cancer-targeting capabilities of monoclonal antibodies, resulting in a safer and more effective package. Sales of currently FDA-approved ADCs are seen growing to some $18 billion in the U.S. by 2030, up from around $5 billion in 2023.

That’s impressive growth, but we think ADCs are still in their infancy. Technological advancements in ADC components are overcoming key limitations, allowing for further innovations, and big pharma companies are investing heavily through deal-making: in 2023 Pfizer acquired Seagen in a $43 billion deal, while Merck and Daiichi struck a $22 billion deal to collaborate.

An overview of ADCs

Introduced in the 1940s, chemotherapy offers a potent way to kill cancerous cells. But it’s a very imprecise and toxic way to attack cancer, causing significant damage to noncancerous areas in the body. Monoclonal antibodies emerged in the 1980s as an advance in immunotherapy: the idea of using the body’s immune system to attack cancer cells. Monoclonal antibodies are Y-shaped proteins that bind to cell surface markers primarily found on cancer cells and then can activate and guide the immune system straight to the cancer. The problem is that they don’t offer direct, intrinsic cancer-killing capabilities.

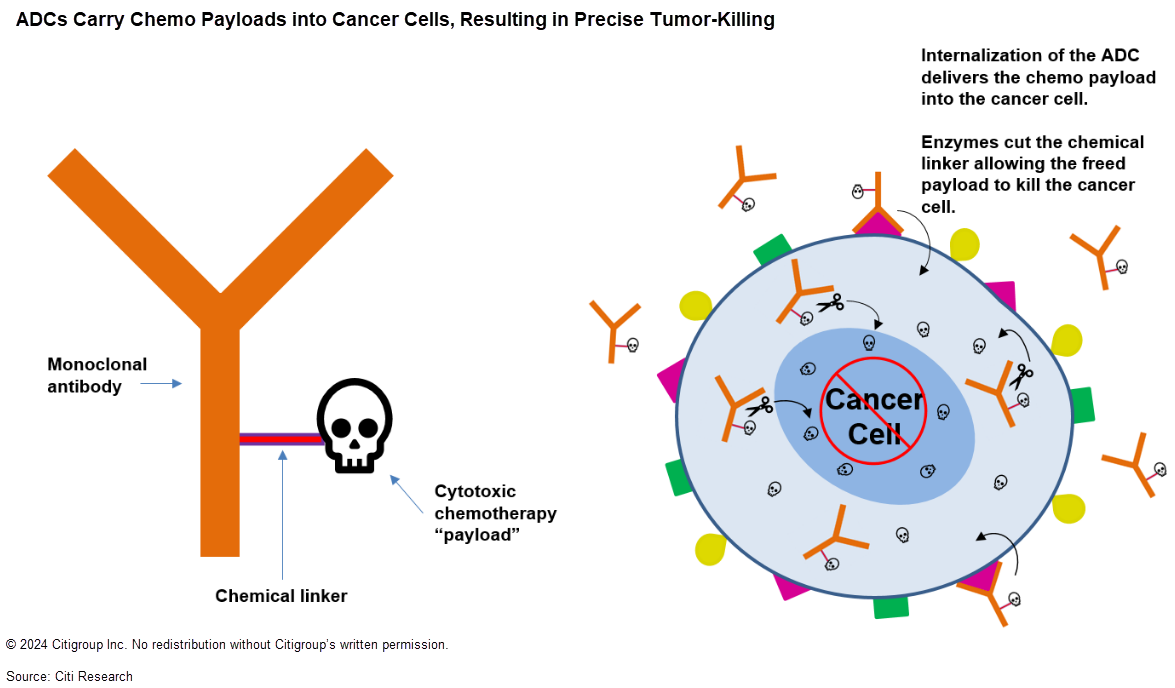

Enter ADCs, which are monoclonal antibodies with very small amounts of highly potent chemotherapy chemically attached to them via a “linker.” (This attachment process is called “conjugation,” hence the name antibody drug conjugate.) Once locked onto a target protein, an ADC enters a cancer cell via a process called internalization. Its linker is then clipped by enzymes, freeing the cytotoxic payload and killing the cancer cell. The stability of the linker is a critical factor in ADC design: An unstable linker can release its payload prematurely, resulting in less drug reaching the tumor and more systemic toxicities.

Target selection for ADCs is critical to avoid systemic toxicities. Another important consideration of target selection is internalization dynamics — higher ADC internalization rates mean larger amounts of cytotoxic payload delivered into tumor cells.

Typically, ADCs carry cytotoxic payloads too potent to be safely dosed systemically in their free form. These payloads are in the range of 100 to 1,000 times more potent than those used in small-molecule chemotherapies; a small amount of drug delivered directly to a target cell should be sufficient to induce cytotoxicity. In theory, ADCs can be far safer than chemotherapy and offer a wider “therapeutic window” in which dosages fall between ineffectiveness and excess toxicity.

ADCs’ potential

Since 2011, 11 ADCs have been approved and are currently on the market. Many approved and discontinued ADCs faced significant safety challenges, mainly due to limitations in the engineering of proteins, linkers, conjugation and chemo payloads. But all these technologies have improved dramatically in recent years, allowing for more stable ADCs and increased efficacy and safety. These improvements have advanced ADCs’ promise and accelerated research and investment interest from biotech and pharma. Eight of the 11 available ADCs were approved between 2018 and now, highlighting this acceleration.

A key commercial advantage of ADCs is their design complexity. They include multiple components, each with its own intellectual property, and so may be difficult for generic competitors to replicate. This could give ADCs long, uninterrupted commercial lives in comparison with easier-to-replicate oncology agents. Pfizer cited this dynamic as a key reason for the price it paid to acquire Seagen, and we expect ADCs to be a growing contributor to big pharma topline revenues.

R&D efforts around ADCs remain very robust, with continued innovations. Hundreds of ADCs are now in development for oncology, and we believe continued innovation will be driven by substantial M&A activity around them, as well as by collaborations and partnerships such as that between Merck and Daiichi. Other variations of ADCs are being rapidly commercialized and clinically developed, such as radiopharmaceuticals that use radioactive isotopes instead of cytotoxic payloads; immune-stimulating ADCs; and ADCs for use outside of cancer, such as treatment of autoimmune or infectious diseases.

Our new report, Citi’s Global Healthcare Conference Innovation Series – Edition 1: Antibody Drug Conjugates, also includes a list of our favored ideas for investors seeking exposure to ADCs and an exploration of upcoming catalysts. It’s available in full to existing Citi Research clients here.