He says that:

- AI is especially important for biopharma, because AI can understand biology in a way that humans cannot; and

- Biopharma is in a particularly strong position to adopt AI, because it is simultaneously highly profitable and extremely inefficient (given the iterative trial and error approach towards drug discovery).

Here’s a bit more on each of those points.

1. AI is especially important for biopharma

The reason AI is likely to have such a profound impact in biopharma is that the same sort of transformer technology that can (sort of) understand natural languages like English can also be applied to long molecules like proteins and RNA. Humans understand and can manipulate English better than AI can; by contrast the way molecules work is not intuitive to humans. As a result, it’s fair to say that in many ways AI understands the language of large bio-molecules better than humans do.

One sign of AI’s power to change biopharma is that several of the individuals who have been at the cutting edge of AI are now focusing on using AI to accelerate the development of drugs – for example, Demis Hassabis (the founder and CEO of DeepMind) and Daphne Koller (a former professor of computer science at Stanford).

Another indication is that of all the academic papers on AI, the ones that have been most cited in the past couple of years have actually focused on proteins.

2. Biopharma is also in a very strong position to adopt AI

Biopharma operates a business model quite unlike any other industry, and many of the peculiarities seem tailor-made to adopting AI:

- Lots of cash to invest in AI. When drugs are approved they operate as quasi- monopolies, with very high margins. This means both that many pharma companies have strong cash flows, and that there are huge levels of R&D investment in the biopharma sector.

- There is plenty of scope for AI to bring improvements because the industry involves extraordinary inefficiencies. Developing new drugs often takes 15 years and costs billions of dollars. Typically, thousands of molecules are tested before one is taken to clinical trials – but even then 92% of the candidate drugs fail in clinical trials. For those drugs that succeed, it takes an average of more than a decade from the start of clinical trials to approval.

- And time is of the essence. Biotech companies have to file patents on their drugs before they start clinical trials, and the patents last for only 20 years, at least in theory. Even though they are often extended in practice, pharma companies have only a limited number of years to generate returns from the drugs. Anything that can bring drugs to market faster is therefore likely to have a major economic impact – and there is plenty of evidence that AI should be able to do that.

AI is likely to improve the industry’s cashflow:

- New drugs can generate revenues in the billions. If AI allows new drugs to be found – to drug the previously undruggable – then the upside could potentially be worth billions of dollars.

- Bringing drugs to market faster can improve cash flows very substantially. AI can produce drugs more quickly, which means the drug is likely to produce revenue for a greater percentage of the patent period. Accelerating approval by 12 months can increase the NPV of a drug by $100 million.

- Better drugs can generate higher revenues. AI-designed drugs have the potential for greater revenue, even if they are treating diseases where therapies already exist, because they can be targeted more tightly and designed with fewer side effects.

AI can reduce the cost of development substantially, especially in the discovery phase. Exscientia says AI-driven drug development can reduce the costs in the preclinical phases by about 70%, relative to traditional techniques.

Biopharma is the largest subsector within healthcare in economic terms

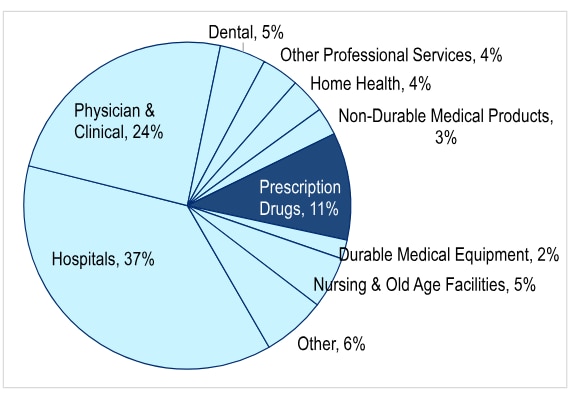

One reason why the impact of AI on biopharma is important is that it is the dominant subsector of healthcare in financial terms. Biopharma accounts for very roughly half of the industry’s profit and investment, even though prescription drugs account for only 11% of spending on healthcare in the US (see first chart below).

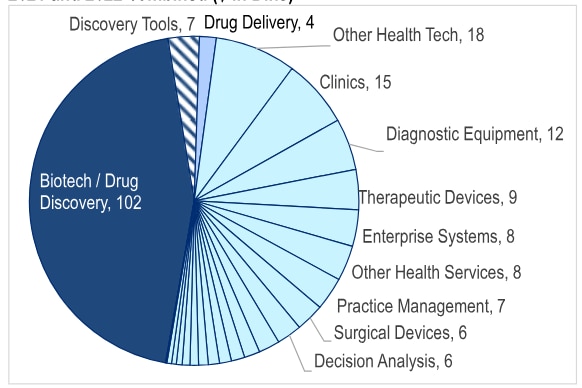

The second chart below shows that over the last two years, $102 billion was invested in biotech and drug start-ups, and a further $7 billion was invested in tools for drug discovery, together making up 48% of total investment by VCs in healthcare.

US Healthcare Spend by Category, 2021

Source: CMS

Primary Capital Raised in Healthcare Startups, 2021 and 2022 combined ($ in Blns)

Source: PitchBook

The full report goes on to look at companies that are using AI in biopharma. Colleagues in Citi Global Data Insights (CGDI) are able to respond to requests to generate screens of companies exposed to the themes in this report, based on a quantitative analysis both of patents filed and of newsflow.

These screens can cover quoted and unquoted companies. They can be ranked in many ways. For example, it is possible to rank by the number of patents obtained related to AI in biopharma, or the quality of those patents, or the percentage of a company’s patents that fall in this area.

Please reach out to the author (adam.spielman@citi.com) or to Helen Krause (helen.krause@citi.com) at CGDI for more information on any of this.

Please find the full report here, originally published on 23 June 2023, and if you are a Velocity subscriber: https://www.citivelocity.com/

And please find the previous reports in the series here:

Smart Thinking on AI in Healthcare: Part 1 – Overview

Smart Thinking on AI in Healthcare: Part 2 – Medical Devices

Smart Thinking on AI in Healthcare: Part 3 – Health Administration

Citi Global Insights (CGI) is Citi’s premier non-independent thought leadership curation. It is not investment research; however, it may contain thematic content previously expressed in an Independent Research report. For the full CGI disclosure, click here.